There’s so much news around at the moment, it’s hard to know where to look.

To make life easier, I’ve collated four important stories about property, finance and cars.

– Auction clearance rates rise

– Government tightens BNPL rules

– New cars in high demand

– Big home loan shift taking place

Read more below.

–

But first, our regular as clockwork updates!

We are almost past the 30 June bun rush.

For some of us it makes for a busy time but if not for you, hopefully you will have a few moments of quiet reflection on the Fiscal Year that was – full of rate rises, with dashes of uncertainty on property prices; and of course, inflation, which underpinned everything which has happened.

Covid has a lot to answer for!

–

Lender’s Carrots

There are so many interesting developments with lenders at the moment.

I am giving you some recent examples for your consideration over a $5.50 latte.

And of course, if you want to find out more…..

So let’s continue..

#1 The Release of the Mortgage Prisoners

Some lenders are assessing servicing on their loans with a ‘reduced buffer’ when the applicant is refinancing.

The logic is a bit complicated but here goes: up until recently, for their servicing assessment, lenders have been applying a buffer of 3% OVER the quoted interest rate; thereby ensuring their clients can make mortgage repayments even if there are future rate increases (by up to 3%).

This caused a problem for borrowers who were showing they could repay their current loan but were unable to demonstrate the capacity to repay a loan with a 3% higher rate; thus preventing them from refinancing even if the refinanced rate was going to save them money.

So whilst the Cashbacks as an incentive to refinance are going, going gone, the reduced buffer is allowing borrowers to migrate from one lender to another.

But as with most things, the devil is in the details….

Nevertheless, I have just put in an application for a client who would not have been able to refinance without the reduction in the buffer rate.

#2 Private Lenders are all the rage

Who would have thought that lenders offering loans at circa 10% would be so popular!

Well, the reasons are simple. They will do deals that the mainstream lenders won’t.

They need an entity other than you or me (aka a company), and it should preferably be trading or have traded.

But apart from that, they are coming to the rescue in ways I would not have imagined in mid 2022.

#3 Retirees, Grey Power, and Unused Equity

There are now a number of products to unlock the equity in your home if you are a retiree.

Reverse mortgages are one option but I now have a couple of alternatives.

So if you are a retiree, or you know one, and you want to access the equity in your home or other properties AND you don’t want to be saddled with a loan you have to repay each month, you have OPTIONS!!!

#4 SMSF Loans that are reducing your retirement pot

Let’s start with a truism: you put money into your super fund to allow you to spend more in your retirement; not to pay exorbitant fees and charges to a lender.

So, if your Self Managed Super Fund has a loan and you have had this loan on ‘set and forget’, it’s time to WAKE UP!!!

If you have had this loan for a few years, it is highly like you are paying OVERS on the rate.

And, whilst you can’t see or touch this money, it could represent quite a bit of your super fund’s income you are giving back to your lender (who, by the way, loves you more each month you leave it where it is).

#5 Bridging Finance made simple

Just the mention of bridging finance turns most clients (and brokers) to jelly.

It’s complicated, you have to take into account ‘peak debt’ and ‘end debt’ and even the calculators are often messy and hard to work out.

Well, now there are OPTIONS!!! With NO SERVICING requirements!

With a typical bridging loan, you can of course get your loan organised for your new property now.

But in today’s changing landscape, have you factored in that ‘Today’s best value lender’ may not be ‘The best value in 3 to 6 month’s time lender’?

I wouldn’t have considered this in years gone by – but these days with so many changes in the lending landscape, I would.

There are now options where you don’t actually PAY ANYTHING until your current property is sold (all the costs and charges come out of the settlement proceeds).

Yes, you pay a premium, but for many borrowers, the timeliness, ease of use and flexibility for some of these options will make these options a worthwhile consideration.

#6 I’m selling but I have NO CASH!!!

“I’m asset rich but cash poor and I DON’T want to convert my assets to cash to pay for agent’s costs, marketing costs, my new car, my holiday, my deposit for my next home.”

Well, I hear you! There are now products which can release the cash in your property with nothing to pay until settlement.

They aren’t cheap but sometimes, when you factor in the alternatives, they are. Plus, they are easy, fast and simple.

–

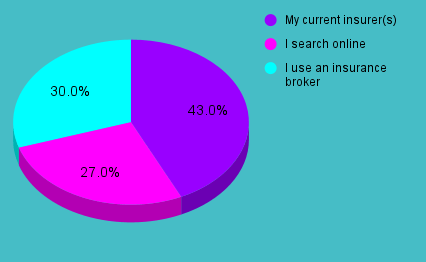

Our survey results are in!

Our question was:

When purchasing a property, who do you use for organising your property and loan protection insurance?

Some observations:

Wow! Let this sink in….

70% of loans are now written via a finance and mortgage broker (i.e. only 30% of customers are going direct to a bank)

BUT

– only 30% of people use an insurance broker

AND

– a further 27% buy online.

Here is what I know. And yes, I am biased because I do use a broker. But you will see why you might like to consider using a GOOD Insurance Broker (we’ll call them GIBs)

GIBs find the best deals.

– GIBS have access to insurance underwriters who only deal with brokers. You don’t.

– GIBS help you lodge your claims and they help you get PAID. For me, this is a BIG BIG benefit.

– GIBS take the uncertainty and hassle out of insurance. Form filling, claiming, comparing, not getting ripped off….

So particularly if you have a business, USE A GOOD INSURANCE BROKER.

I have a couple of brokers I would recommend – just ask me for some names.

Please email me your Good Insurance Brokers

–

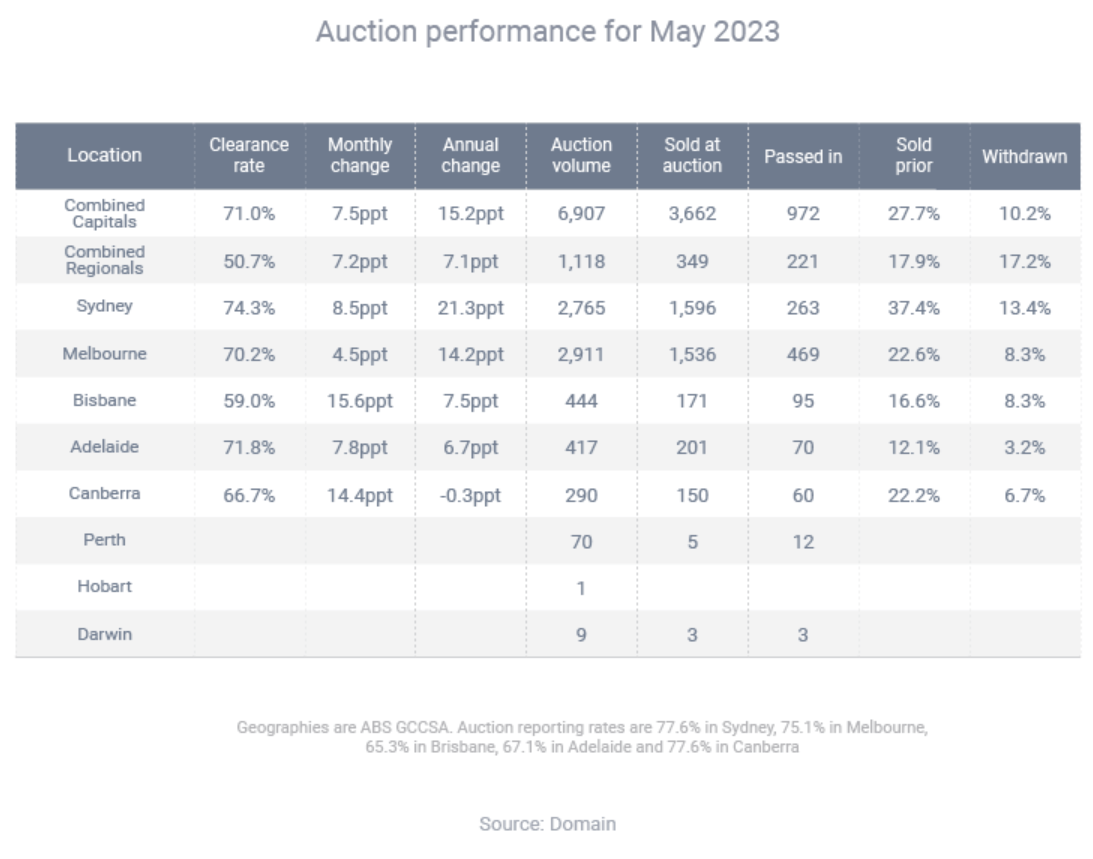

Research from Domain has uncovered one key statistic that suggests the national housing market is recovering.

The combined capital cities had a clearance rate of 71.0% in May – a significant increase on the year before (55.8%) and the highest figure since October 2021.

Over the year, clearance rates rose in four of the five major auction markets – Sydney (by 21.3 percentage points), Melbourne (14.2 points), Brisbane (7.5 points) and Adelaide (6.7 points).

The sole exception was Canberra, where clearance rates fell by 0.3 percentage points.

“The continual rise in clearance rates aligns with the broader momentum that has built as Australia’s housing market begins to recover,” Domain’s Chief of Research and Economics, Nicola Powell, said.

While clearance rates are surging, auction listings remain weak across the combined capital cities.

“The mix of high interest rates, rising prices and rents, and lack of housing supply, shows that even though there are less homes going under the hammer, buyers are willing to place favourable auction offers when choice remains limited,” Dr Powell said.

See how much you can borrow now!

–

Buy-now-pay-later (BNPL) products will soon be regulated like traditional loans, after the federal government concluded they’re loans in all but name.

“BNPL looks like credit, it acts like credit, it carries the risks of credit,” Minister for Financial Services Stephen Jones said in a speech to the Responsible Lending & Borrowing Summit.

Under the government’s new legislation, which will be introduced to parliament by the end of the year, BNPL providers will be required to hold Australian Credit Licences and comply with responsible lending obligations, just like home loan and car loan lenders.

But Minister Jones said the issue is nuanced. On the one hand, there are “unacceptable levels of unaffordable lending occurring” in the BNPL sector right now.

On the other hand, BNPL has “provided a valuable source of competitive pressure on traditional credit products, such as credit cards or payday loans”.

Therefore, he said the government’s legislation would strike an appropriate balance.

“Our plan maintains the benefits of BNPL that many Australians enjoy, and we must ensure that providers will have appropriate safeguards in place, and we must ensure that they operate honestly, efficiently, and fairly, in line with other regulated credit products,” he said.

–

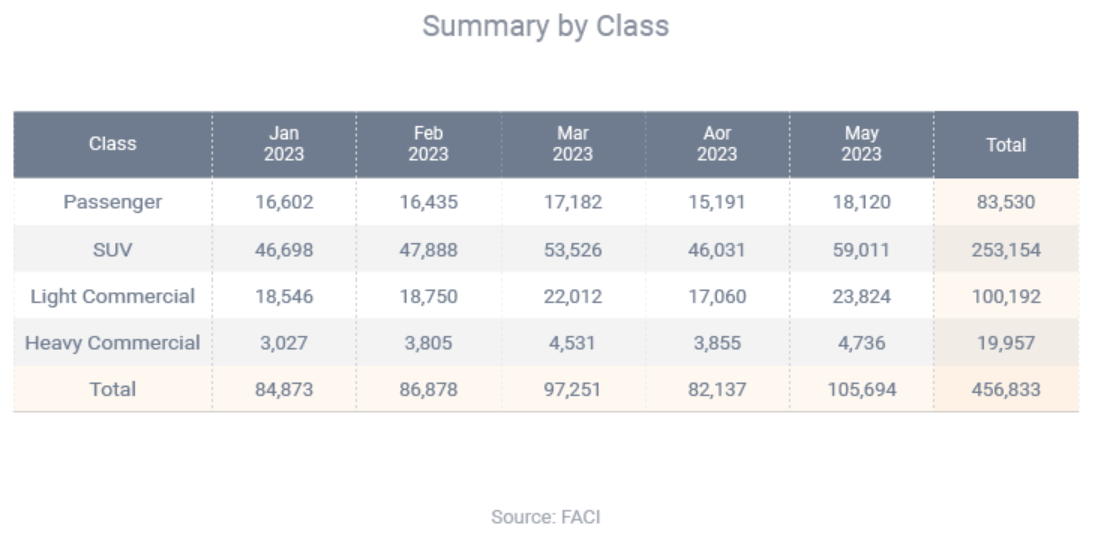

While consumers have reduced their spending in some parts of the economy, they’re buying cars in record numbers.

Australians purchased 105,694 new vehicles in May, which was a record for the month of May, according to the Federal Chamber of Automotive Industries (FCAI).

The May result was 2.7% higher than the previous May record (in 2017) and 12.0% higher than the year before.

Meanwhile, the number of new vehicles sold in the first five months of 2023 (456,833) was 4.3% higher than the same five-month period in 2022.

FCAI Chief Executive Tony Weber said the recent spike in sales followed an extended period where deliveries were hampered due to shipping and logistics problems.

“This result is a signal that we are starting to see some improvement in supply. However, not all issues are resolved, and our members continue to work with their customers to improve vehicle delivery times,” he said.

Mr. Weber said that while households and businesses were concerned about rising costs, reports from automotive dealers suggested demand remained firm.

Get in touch if you need a car loan!

–

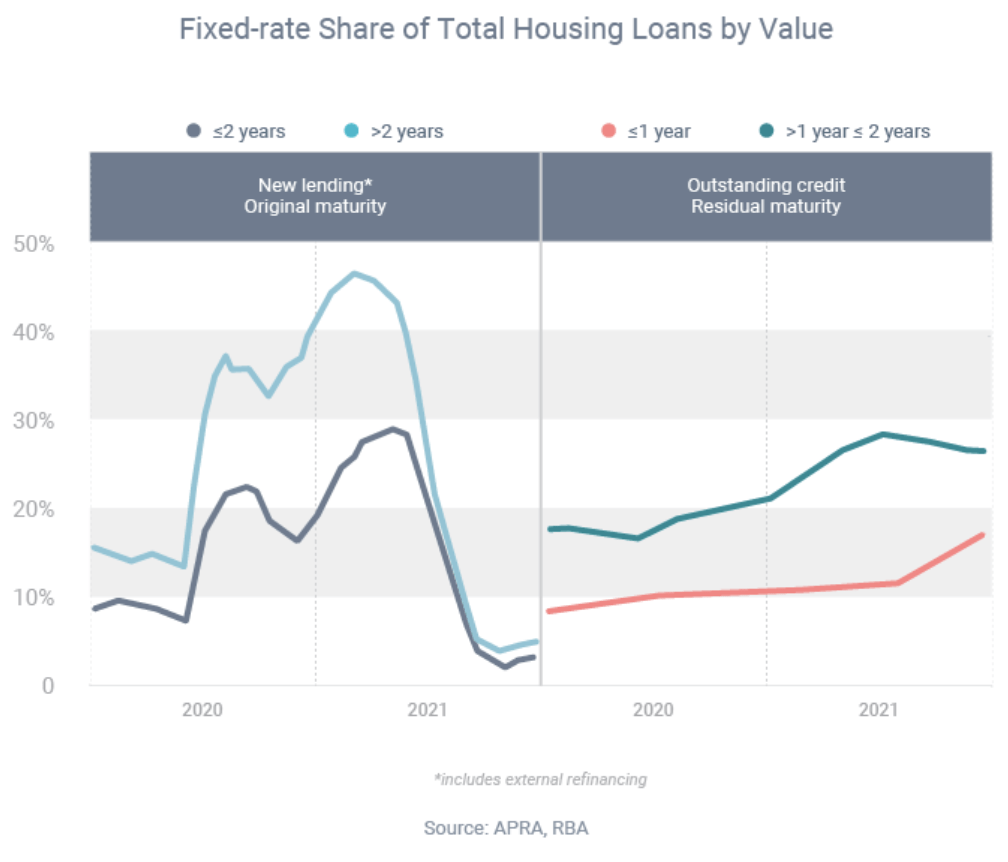

Australia is halfway through an historic shift of about two million home loans reverting from fixed to variable interest rates.

As of May, about 30% of outstanding home loans were fixed, according to the Reserve Bank of Australia (RBA) – a share that is falling from historically high levels.

An RBA research paper found that fixed-rate borrowing surged during the 2020 pandemic – in response to record-low fixed rates – “peaking at almost 40% of outstanding housing credit in early 2022, or roughly twice their usual share from prior to 2020”.

Most borrowers who fix do so for three years or less, so most fixed-rate loans that were taken out during the pandemic surge have expired recently or will do so soon.

“This equates to 590,000 loan facilities in 2022, 880,000 in 2023 and 450,000 in 2024. The profile of expiring fixed-rate loans is similar across the states and territories and between capital cities and regional areas,” according to the research paper.

Borrowers who are reverting from fixed to variable are generally being confronted with much larger repayments, as interest rates have risen significantly since mid-2022.

If you’re in that position, or will be soon, contact me to discuss your refinancing options, as I may be able to help you switch to a lower-rate loan.

–

For FREE Property Reports: Click Here