If you are new to BIR Finance, we have a monthly newsletter on properties and finance – with some insights not everyone gets to see.

One welcome piece of news from earlier this month was the Reserve Bank keeping the cash rate on hold. Finally (wait for it….), the mortgage belt can take a break from doing the heavy lifting to curb inflation.

But I had to laugh/cry when I read this quote from Deloitte Access Economics:

As Deloitte Access Economics has been warning for the past 12 months – and as the Reserve Bank’s own research shows – excessive inflation in Australia has mostly been caused by supply-side factors, meaning that interest rate increases have mostly been ineffective at bringing inflation under control.

Which has been my (often-expressed) view for many months. Oh well, Phil is gone but will Michele be any different? Meanwhile, those without a mortgage continue to sip voraciously on a champagne or two!

Back to script….

Here’s what else has made headlines in July:

– Key property price stat.

– Cash rate gets reformed.

– ATO issues a tax warning.

– HomeBuilder update.

Read more below.

But first for some of our regular updates….

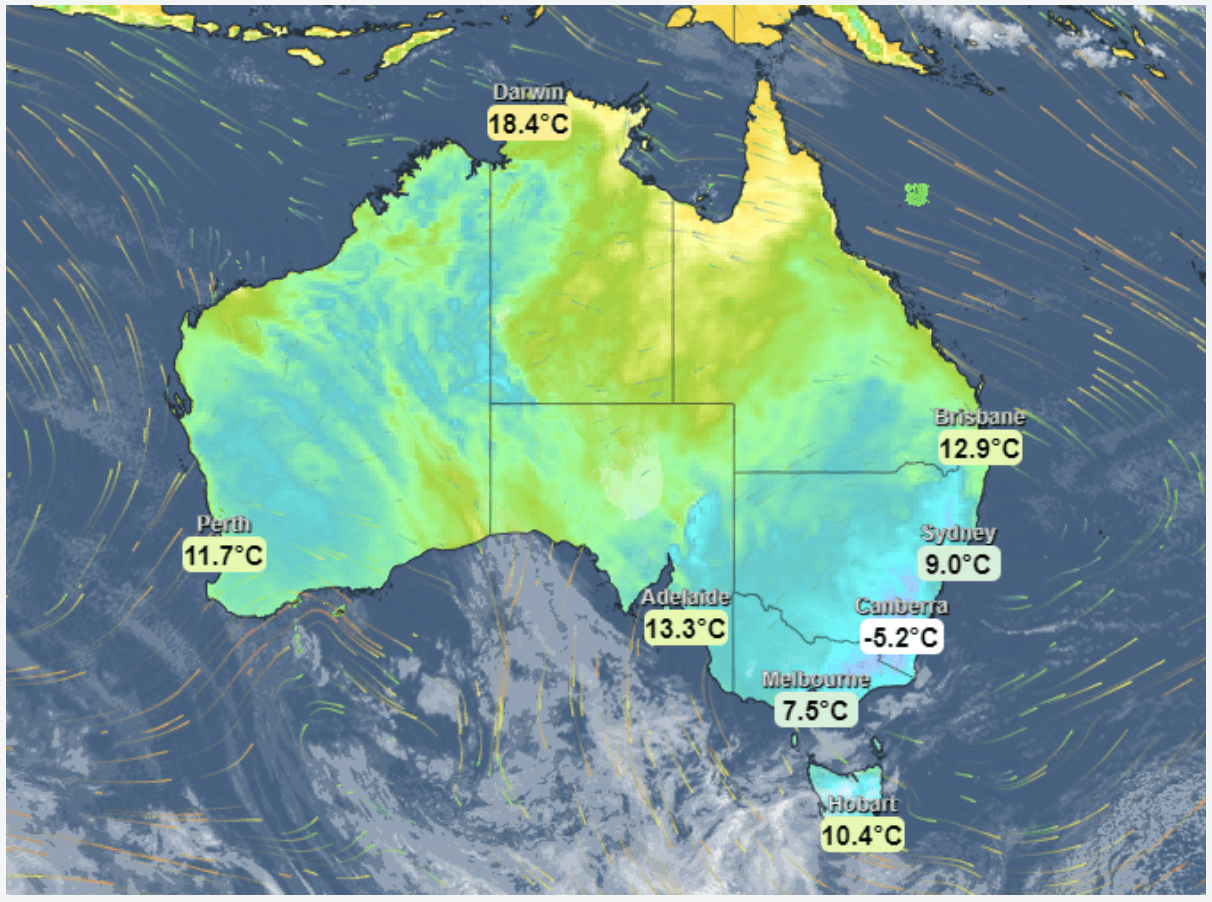

Last week, a Big 4 BDM lender complimented me on my relevant posts on LinkedIn. To grow my head even larger, he said he shared them with his colleagues!!! Now I know he wants business from me but that glowing praise kept me basking in the sunshine on a cold and miserable Melbourne winter’s day – so it was all worth it! Thanks Anuj 🙂

Talking of Melbourne’s glorious weather, my wonderful VA in the Philippines, Anna, who gets these newsletters ready each month (thanks Anna!), said earlier this week, she was ‘feeling the cold’. I asked, ‘How cold is cold?’ She replied ’28 degrees’. I shivered.

Client Story

My clients have had some good wins over the past few weeks but one thing stands out: I would hate to be a client dealing directly with a lender!!!

We have spent a LOT of time providing documents to lenders which we had already provided to them. Luckily, we are patient and persistent (and always pleasant!).

Tip: the reduced buffer rate offered by some lenders is proving the difference between a successful refinance and a ‘Sorry, you don’t pass the servicing test for any lender’.

If you are looking at refinancing, give me a call or email me. Via Zoom, you will be able ‘to see what we see‘ – and in particular, which lenders will be likely to say ‘Yes’ to your refinance. And I can explain to you what is a ‘lender’s buffer rate’ 🙂

Finance Tip

Yes we are a broker and we are here to get you money. That’s why you are talking to us, right?

But behind every request for money is often a much bigger goal which our clients want to achieve.

Yours could be:

– Having the security of knowing you have a place you can call ‘home’

– Growing your pool of assets so you can have a comfortable life in the future

– Saving money so you can afford your day-to-day essentials

So my question to you is:

Do you know what is your why and do you have a plan to achieve it?

Helping you sort out your why is not my thing but I know some good people who can point you in the right direction.

If you want a referral to one of my gurus, just let me know.

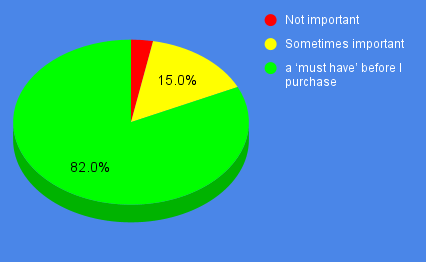

Our survey results are in!

Our question was:

How important is a property inspection report when you are purchasing properties?

Some observations:

Ok, the bleeding obvious – where are the 3% (that thin red slice) when you are selling your properties?

Bad joke but it had to come out.

The reality is that properties’ inspections can save you heaps of $$$ by protecting you from buying the wrong properties or not being aware of the costs to be incurred if you buy it.

A property inspector I know is also a registered builder. And HE says, properties’ inspector who is not qualified in the industry cannot know what they don’t know.

So, if I was you, I would DEFINITELY ask for the qualifications of your next building inspector – and those who are qualified builders have a running start. Plus if they are on the small/slim side and not afraid of heights or small spaces then even better, as it means they are able to get into those places the rest of us have no interest in.

Of course, if you are Melbourne-based and you would like to be introduced to some good inspectors, let me know. Happy to make the introduction.

Connect me with a property inspector – 0411 190 474

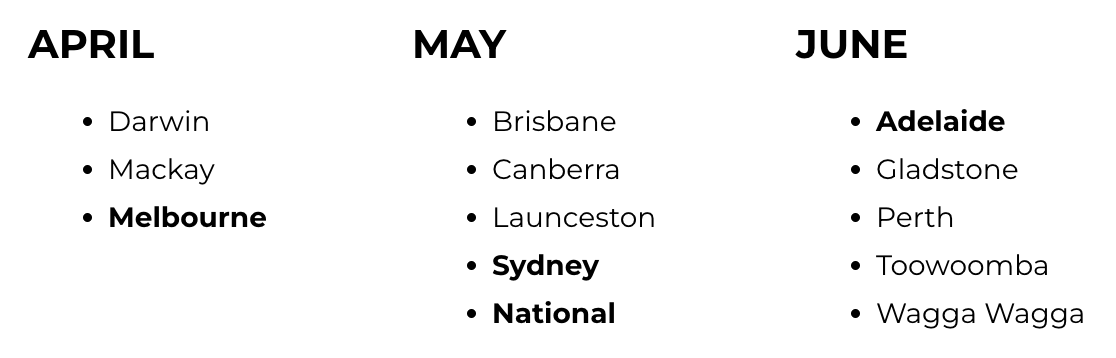

Regional Property Report Updates

For investors, this is a bonanza offering for 30+ regions around Australia. The level of detail and research is ‘second to none’ so delve into them before making your next properties investment decision.

Tip #1: if you don’t have properties investment advisor, do yourself a HUGE favour and make sure you use one!

I have quite a few seasoned professionals who can assist you (including the authors of the Regional Property Reports), so I can certainly put you in contact with someone who can make your next buying decision a better one.

Tip #2: your biggest cost of your next properties purchase is the opportunity cost of choosing the wrong properties.

A 2% to 3% inferior annual return adds up to big $$$ over 5 to 10 years.

The last 3 months updates:

Click here for access to our Regional Reports

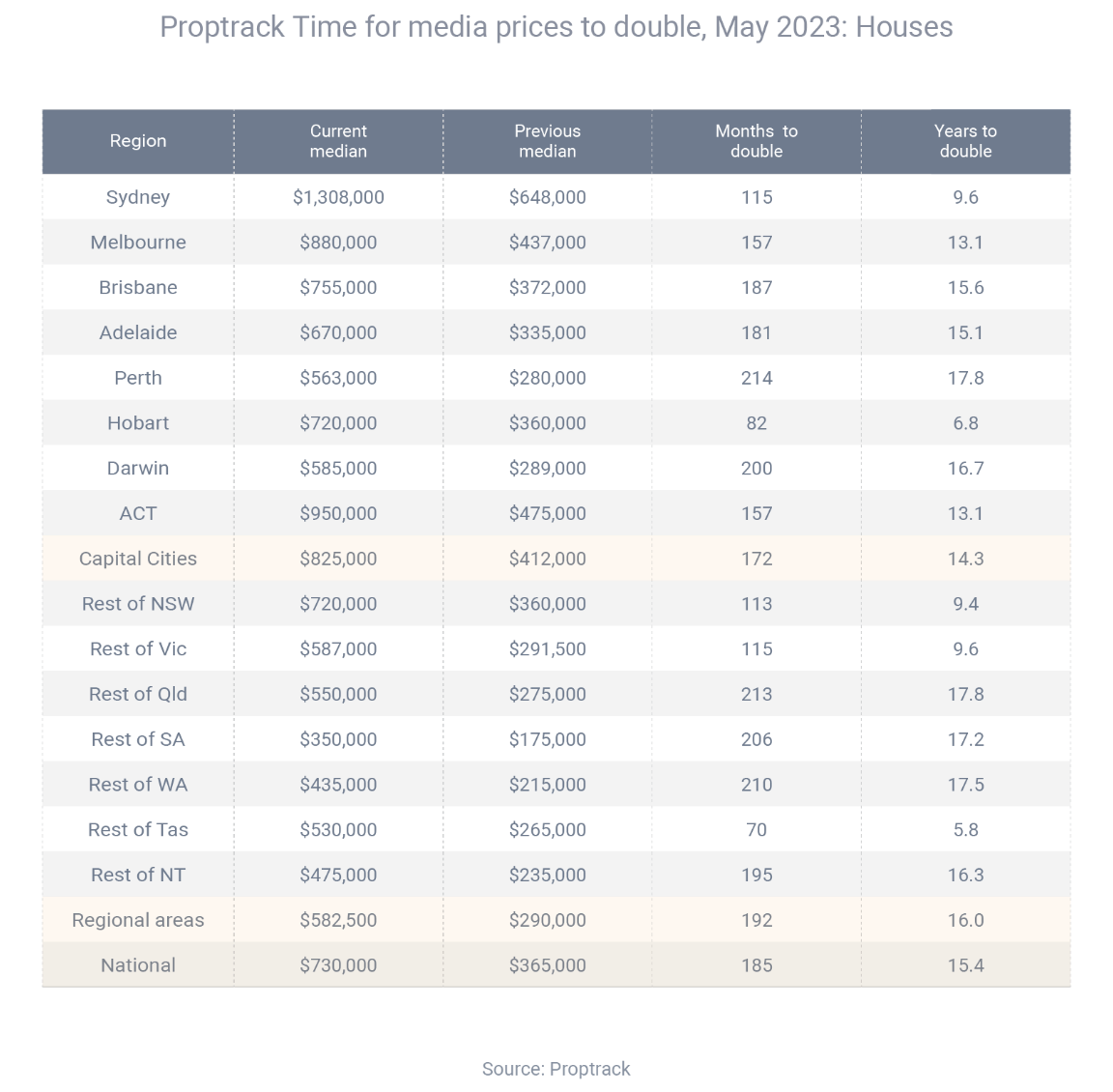

According to PropTrack’s recent research, properties’ prices in Australia have shown robust growth over the years, with the most recent doubling of prices being of particular interest. In May, the median price for houses reached $730,000, while units were priced at $560,000.

Upon analyzing the data retrospectively, PropTrack discovered that house prices doubled over a period of 15.4 years, whereas unit prices took 17.8 years to double. This information highlights the steady and consistent appreciation of properties values in the Australian real estate market.

Breaking it down by geography:

– House prices doubled in 14.3 years in the capital cities and 16.0 years in the regions.

– Unit prices doubled in 18.1 years in the capital cities and 17.5 years in the regions.

“Across every capital city and regional area, median house prices have doubled over a shorter period of time than median unit prices have. This highlights that houses tend to appreciate in price quicker than units,” PropTrack Director of Economic Research Cameron Kusher said.

“The lower price point and slower growth also highlights that housing more of Australia in units is a good way to address our housing affordability challenges.”

Get in touch if you need a home loan

The Reserve Bank of Australia (RBA) is set to implement several noteworthy changes in the upcoming months. Firstly, there will be a change in leadership, as the current governor, Philip Lowe, will step down in September and be succeeded by Michele Bullock, the current deputy governor.

Moreover, starting from 2024, the RBA will undergo significant reforms in the way it approaches and communicates monetary policy. Presently, the RBA holds 11 monetary policy meetings annually to review the cash rate. However, under the new approach, the board will convene eight times a year for these reviews.

These meetings will be extended in duration to allow for more comprehensive discussions. Following each meeting, the governor will hold a press conference to clarify the decision made regarding the cash rate. This new approach aims to enhance transparency and provide the public with a clearer understanding of the RBA’s monetary policy actions and reasoning.

“The less frequent and longer meetings will provide more time for the board to examine issues in detail and to have deeper discussions on monetary policy strategy, alternative policy options and risks, as well as on communication,” Governor Lowe said.

“And the post-meeting media conferences will provide a timely opportunity to explain the board’s decisions and to answer questions.”

The Australian Taxation Office (ATO) has issued a warning to taxpayers regarding their work-related claims in this year’s tax return. Assistant Commissioner Tim Loh emphasized that taxpayers should avoid simply copying and pasting last year’s claims, as doing so could raise suspicions.

Mr. Loh highlighted some changes to the rules around certain deductions that taxpayers need to be aware of:

Working-from-home expenses: If you intend to use the fixed-rate method, the rate has increased from 52 to 67 cents per hour worked from home. Additionally, there is no longer a requirement for a dedicated work-space.

Work-related car expenses: If you plan to use the cents-per-kilometre method, the rate has increased from 72 to 78 cents per kilometre.

Self-education expenses: The requirement to exclude the first $250 of certain self-education expenses has been removed.

To ensure accuracy and compliance, Mr. Loh advised taxpayers to seek assistance from a registered tax agent if they are uncertain about any aspects of their tax return. This way, they can avoid errors and submit a correct tax return from the outset.

Applicants for HomeBuilder, a government initiative aimed at supporting the construction industry, have been granted an extended deadline to submit their supporting documentation. Originally set for 30th April 2023, the new deadline now allows applicants until 30th June 2025 to submit the required paperwork.

The federal government had proposed this extension in March, seeking to provide more time for applicants to gather and submit their documentation properly. After some time, all states and territories, which manage HomeBuilder on behalf of the federal government, finally reached an agreement to approve the deadline extension.

This decision aims to facilitate a smoother application process for HomeBuilder and offer applicants the opportunity to meet the requirements without unnecessary rush or pressure.

“This will help thousands of existing applicants access grants of up to $25,000,” the government said.

“It gives all existing HomeBuilder applicants another two years to finalise construction and submit all required supporting documentation.”

“The extension is available for all applicants, including for those with contracts for off-the‑plan purchases, new builds and renovations.”

“Applicants do not need to do anything to access the extension – it will automatically apply.”

HomeBuilder applications closed in 2021, so the grant is no longer available to new applicants. This extension applies only to those who had already been approved, but were affected by supply constraints and construction industry delays.