That’s not me by the way….

Can you believe Santa is coming down your chimney in less than 55 sleeps? I’m a believer and I don’t even have a chimney.

So if you have kids or you just like to shop. it’s time to load up your credit card 😏

In the meantime, here’s what’s making news:

– Housing reforms continue

– Refinancing rises 12.4%

– The downside of dealer finance

– New property trend emerges

Read more below.

Home Buyers’ Glory Days

Nothing like channeling a bit of the Boss.

Lenders are currently offering sharper rates (let’s hope the RBA doesn’t take this all away with a rate increase next week).

Saving you money is what we do.

SMS me on.

–

And as always, if we can’t save you, we’ll tell you.

Simple!

Clients love our Transparency!

Transparency builds trust.

We have had quite a few Five Star Google reviews purely based on an initial discussion with our first-time clients.

And as the Professor used to say…

Why is it so?

Well, first we asked them (don’t ask, don’t get).

They gushed and told us how valuable the meeting was for them.

And they gushed because, unlike many other brokers,

we offered them total transparency and information which most brokers hold close to their chest.

Via Zoom, we share our screen and in under 30 minutes, we show:

– How much they can borrow.

– How many lenders will be likely to lend to them at a particular level of borrowing.

– Who those lenders are.

– The likely monthly repayments they are looking at.

– Plus, we run as many scenarios as they can throw at us.

We do all of this because we know that if the roles were reversed, we would want our broker to give us that level of transparency.

So when you want a broker who is open and transparent, give me a call.

–

Supporting local businesses who are looking to grow!

This month:

I’m good mates with Cheryl Lardner, one of the brains behind Wishkeeper. (She even buys me breakfast!).

We all want to be prepared for the end of our game of life but it can be confronting.

Organising all the paperwork, figuring out who to tell and what (and when) is a challenge in itself. Plus, storing all the keepsakes and memories intact; and even the playlist for your final farewell performance (unless you are John Farnham who will probably come back a few times to do it all again).

Wishkeeper provides all of this and more – there is so much to love about this service. From what I have seen, it is just awesome. And yes, I have signed up!

If you would like to find out more: visit this website: www.wishkeeper.com.au.

And if you would like to take up a special BIR Finance offer (definitely limited time only).

Special BIR Finance Offer:

When you are ready to set up payment, you will get $20 off the lifetime payment for access to Wishkeeper. This is available to the first 15 who apply. Valid until 30 November 2023 . CODE: BIRVIP20

–

Investors, it’s getting hotter!

Take advantage of this incredible opportunity covering over 30 regions throughout Australia. The quality of research and depth of information in these reports are unmatched. Be sure to thoroughly examine these reports before you make your next property investment choice.

Tip

Your most significant expense with your next property acquisition

is the potential cost if you select the wrong property.

A problem you didn’t know existed…. if your annual return is 2% to 3% lower than it could have been, you can accumulate substantial financial ‘opportunity cost’ losses over a span of 5 to 10 years.

For instance, a 2% annual return disparity (5% versus 7%) on a $500K property acquisition translates to a lower capital gain of $63K over 5 years and $179K over 10 years.

Your solution?

Use a great property investment advisor. We can put you in touch with those investment advisors who will give you well-researched options which are suitable for you.

Get to know some great property investment advisors!

Below are the recent updates from the Regional Property Reports for the past three months:

Access your Regional Property Reports!

–

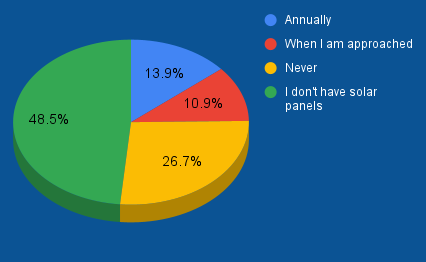

Our latest survey results are in!

How often do you clean your solar panels (grime reduces the efficiency)?

How often do you clean your solar panels (grime reduces the efficiency)?

Yikes! Almost 50% of those who responded don’t have solar panels. And of those who do, about a quarter clean them annually (the remaining three quarters are harbourers of dirt 😉).

I have a local window/exterior/roofing cleaner who does just that – cleans your solar panels. And when he shows you the ‘before’ and ‘after’ pics of one of his cleans, you realise we live in a pretty dirty world (ok, it is Melbourne, I get it).

So, if you have solar panels, GET THEM CLEANED!!! And maximise the Government’s rebate! 💲

Connect me with a great solar panel cleaner!

–

The federal government has introduced Housing Australia, a new agency with a dual mandate. Firstly, it will assist first-time homebuyers in entering the housing market, and secondly, it will oversee the provision of social and affordable housing.

Housing Australia has assumed control of all programs previously managed by the National Housing Finance and Investment Corporation. This encompasses the First Home Guarantee, aimed at first-time homebuyers, the Regional First Home Buyer Guarantee, designed for those in regional areas, and the Family Home Guarantee, intended for single parents.

In addition, Housing Australia has taken charge of the National Housing Infrastructure Facility, which extends concessional loans and grants to developers and utility providers.

Furthermore, Housing Australia will be responsible for implementing social and affordable rental housing initiatives funded through the government’s $10 billion Housing Australia Future Fund and resources allocated under the National Housing Accord for the development of new affordable rental housing.

“It’s all part of our broad housing agenda to ensure more Australians have a safe and affordable place to call home – whether they’re buying, renting or needing a safe space to spend the night,” Minister for Housing Julie Collins said.

–

Compared to the previous year, there is a decrease in the number of new loans being taken out by borrowers, while the rate of refinancing existing loans has significantly increased.

In August, both owner-occupiers and investors engaged in external refinancing, totalling $20.6 billion, which represented a substantial 12.4% increase from the previous year, as reported by the Australian Bureau of Statistics. The current surge in refinancing activity can be attributed to the attractive opportunity for individuals to secure lower interest rates offered by alternative lenders.

At the same time, borrowers took out $24.8 billion of new home loans in August, which was 9.4% lower than the year before. Breaking down those figures:

– 77% of new loans were used to buy existing properties.

– 11% were used to build new homes.

– 5% were used to buy new homes.

– 4% were used to buy land.

– 3% were used for renovations and additions.

Get in touch if you’d like to refinance to a lower interest rate, buy a property or renovate your current home. I’ll compare home loans for you and manage your loan application. That way, you’ll be confident of getting a competitive home loan while doing very little of the work yourself.

Want to compare interest rates? Let’s talk!

–

Last week I had a new client who wanted to finance the purchase of a new vehicle. He said ‘The dealer offered me he a great rate! 3.4%!’

‘Wow!‘, I said, ‘That is a great rate!!! Did he tell you what were the fees and charges?‘ He responded ‘Ummm, no he didn’t.. Fees and charges add up as they are a fixed cost each month irrespective of the debt remaining to be paid so as a percentage, they can get quite high.

‘Did he show you the effective interest rate you were paying once you included all fees and charges?‘ Silence.

‘What abut the exit fees? Did he cover this with you?‘ A shake of the head. ‘Oh, so if you want to refinance, you might need to pay a (high) exit fee?’ More silence.

Moral: when something is too good to be true, it normally is.

The reality….

Dealers love clients who need finance.

Why?

– It weakens your negotiating power. We all know Cash is King. So getting a sharp price through a well-timed haggle is probably not going to work as well as you would like if you need to ask them for a loan…..

– They can make more money than if they just offer you a vehicle – so they might lose on one part of the transaction but gain on the other. Remember this.

– Dealers use one finance company. No matter who you might be able to borrow from, you are stuck with their choice – even if it is not the most suitable for you.

This is why opting for a car loan through a finance broker is generally a wiser decision.

Plus, with BIR Finance, you get access to our (almost) famous free car buying service – where someone does the hard yards and haggling for you and gets your vehicle delivered to your door (Paul Kelly wrote a song about this).

The solution?

Before you begin your vehicle search. I’ll assess various lenders, loan products, and interest rates to provide you with not only a favourable loan but also an understanding of your borrowing capacity.

Once you’ve selected your vehicle, I’ll assist you in securing unconditional approval for your loan, allowing you to formally take ownership of your new vehicle.

Get in touch if you need a car loan!

–

CoreLogic has uncovered a hidden gem of information: since the pandemic, the share of people who sell their homes after holding for less than three years has risen sharply. In the August quarter, it hit a record 16.0%, compared to the long-term average of just 7.9%.

“Short-term resales can occur for many reasons, including people ‘flipping’ homes, making large capital gains, or moving for work. But in an environment where interest rates have risen rapidly and cost of living pressures are high, resales due to mortgage serviceability constraints may also be a contributor,” CoreLogic’s Head of Residential Research, Eliza Owen, said.

“The accelerated rise of short-held listings … is distinctly noticeable from May 2022, when the underlying cash rate started to move higher from record lows.”

Ms Owen said the rise in short-term resales was unlikely to affect the stability of the mortgage market, especially while property prices were rising.

“In fact, periods of strong capital gain can be associated with short-term reselling, because the seller can realise a strong profit which can offset high transactional costs or might be put towards buying a higher quality property.”