Hi,

March has been one of those months in which the media has been filled with property and finance news. These four stories really stood out:

– First home buyer update

– Property price surprise

– New vehicle sales climb 1.8%

– RBA hints at rate relief

Read more below.

But first….

Some things you might like to know!

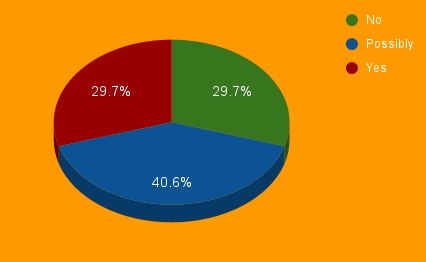

– The results of our new poll are out! Our question was: As a property purchaser, would you consider using a buyer’s advocate?

– We have more updates for our regional property reports which cover the capital cities and in total, 30+ regions. The last 3 months of updates are set out below.

– Our 5 suburb comparison report is great for buyers looking to buy in a specific area when they are not 100% sure which suburb to buy in. And as we know, property prices and trends can often vary significantly between neighbouring suburbs. Click the link below to find out what you might not know.

#1 Our survey results are in!

Our question was: As a property purchaser, would you consider using a buyer’s advocate?

Some observations:

– Wow! Almost 30% said they would use a buyer’s advocate with a similar percentage saying they would not; with the balance ‘swinging in the middle!

– These days, I always recommend to my clients to consider using a buyer’s advocate. For me, the reasons are clear. Let me list some of the things which I think about when I am buying a property:

Property is an expensive purchase

Buying a property is like buying a business. It costs a LOT of money. And, when you are borrowing a lot of that money from someone who wants you to pay it back, you better make sure you are making the right decision! Your Return on Investment (ROI) should always be a prominent consideration.

What due diligence would you do if you were buying a business?

To take the above point to the next level, if I am buying a business, I will do all sorts of due diligence to make sure it is the right business opportunity for me. And if I am new to the industry, I will probably spend more $$$ having my legal and financial experts (or buyer’s advocate) run their eyes over it to make sure I don’t miss the bleeding obvious.

I am a ‘part-time’ property expert.

I don’t buy properties for a living. I know (from experience unfortunately!), that there is a lot about buying a property which I don’t know. And to double down on this point, you only find out what you don’t know when things don’t turn out the way you expected they would. At which point, it is too late to fix.

Experience converts to $$$

When you pick the buyer’s advocate, and when what is at stake is significant, you will do two things:

– save money on those things which cost you

– make more money by increasing your return on investment

If someone who has expertise in property due diligence can stop me from buying the wrong property, then that is worth its weight in gold.

But if this experienced person can leverage their knowledge so I can get a 1% to 2% better return per annum, I will be WAY AHEAD ahead after 5 to 10 years. (The maths says I will be 16% to 34% better off if the annual growth rate is 5% pa and they can improve my ROI by 1% to 2% pa).

My time is expensive

I am not just talking about what else I can spend my time doing to make more money, although that of course is important. I am also talking about the time I could be spending with my wife and kids at their soccer training or helping them at home.

Picking the right expert is important

There are a lot of excellent buyer’s advocate out there. However, like any industry, there are also a few you should avoid.

I know a few buyer’s advocates. I make it my business to have a chat with them so I can understand what sort of people they are and what processes they follow to ensure they make the best decisions for their clients.

If you want some names, just let me know and I would be happy to make an introduction.

#2 Updates to our Regional Property Market Reports

These Reports are a great resource for those looking to buy in a new region or just to get a feel for what is happening in that region. Each Report also includes a suggested recommendation to Buy / Hold / Sell.

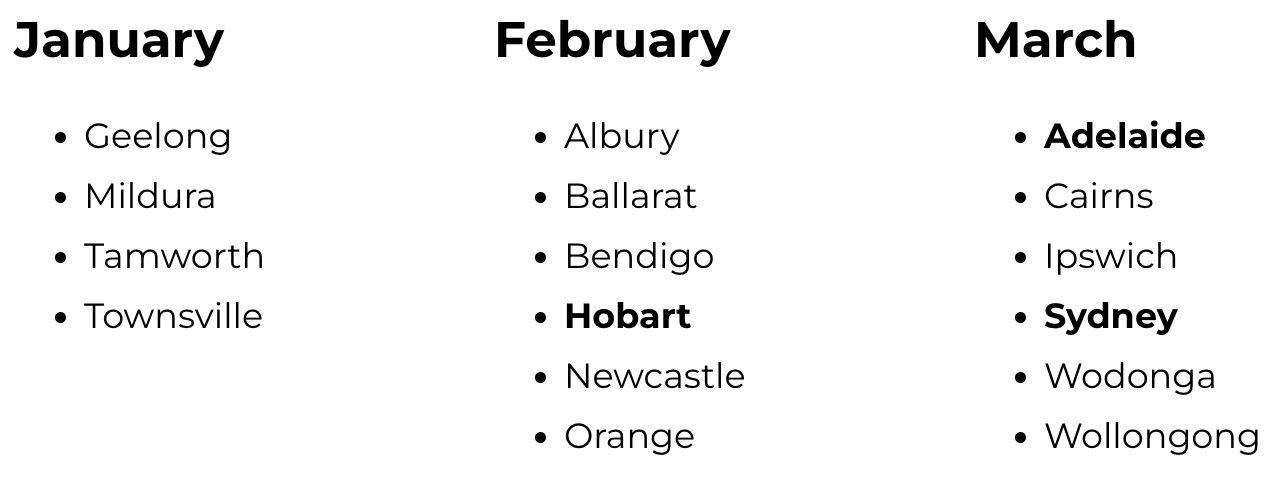

Updated Regional Property Reports

Here are the last 3 months’ updates of these detailed regional reports (including the property clock: Buy / Hold / Sell).

There are 30+ regions analysed and they are updated regularly.

Get your Free Property & Regional Reports!

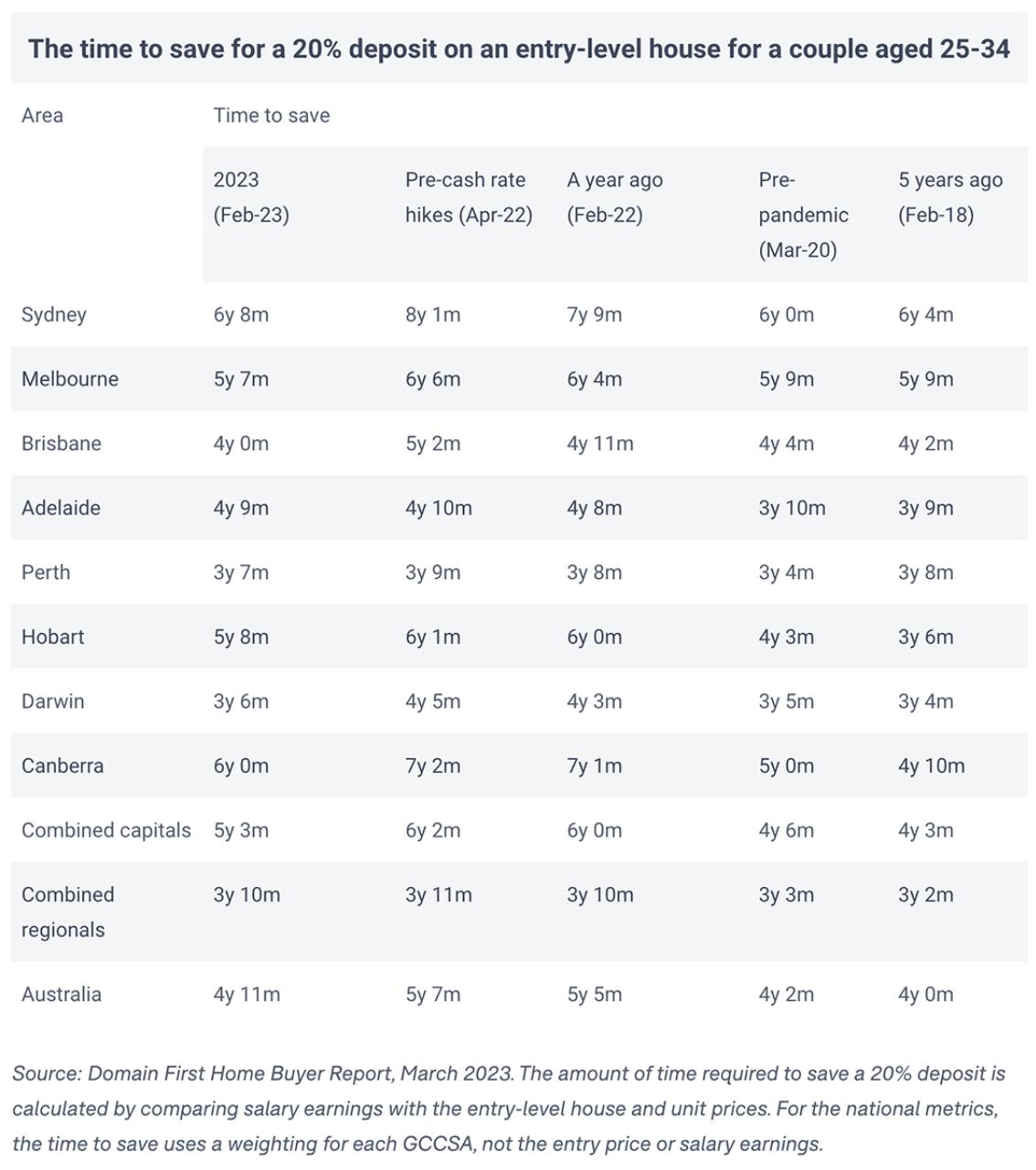

Whether you want to buy a house or unit as your first home, you now need less time to save a deposit.

Domain research found that between April 2022 and February 2023, the time required for an average couple aged between 25-34 years to save a 20% deposit for an entry-level home fell from:

– Houses – 5 years 7 months to 4 years 11 months.

– Units – 3 years 10 months to 3 years 7 months.

Domain said there were three reasons first home buyers were now saving their 20% deposit faster.

First, property prices have fallen over the past year, which means first home buyers now need to save less money to enter the market.

Second, interest rates have increased, which means first home buyers are earning higher returns on their savings accounts.

Third, wages have also grown during that time.

Sooner or later, property prices are likely to start rising again*, so if you want to buy your first home, now may be the right time for you. Contact me if you’d like help. I can explain how the buying process works, compare home loans for you and help you secure finance.

* And if you are not sure about this, have you seen the recent media reports on our ‘soon to be record immigration levels’? When our migration ramps up, property prices will only go one way…..

See how much you can borrow now!

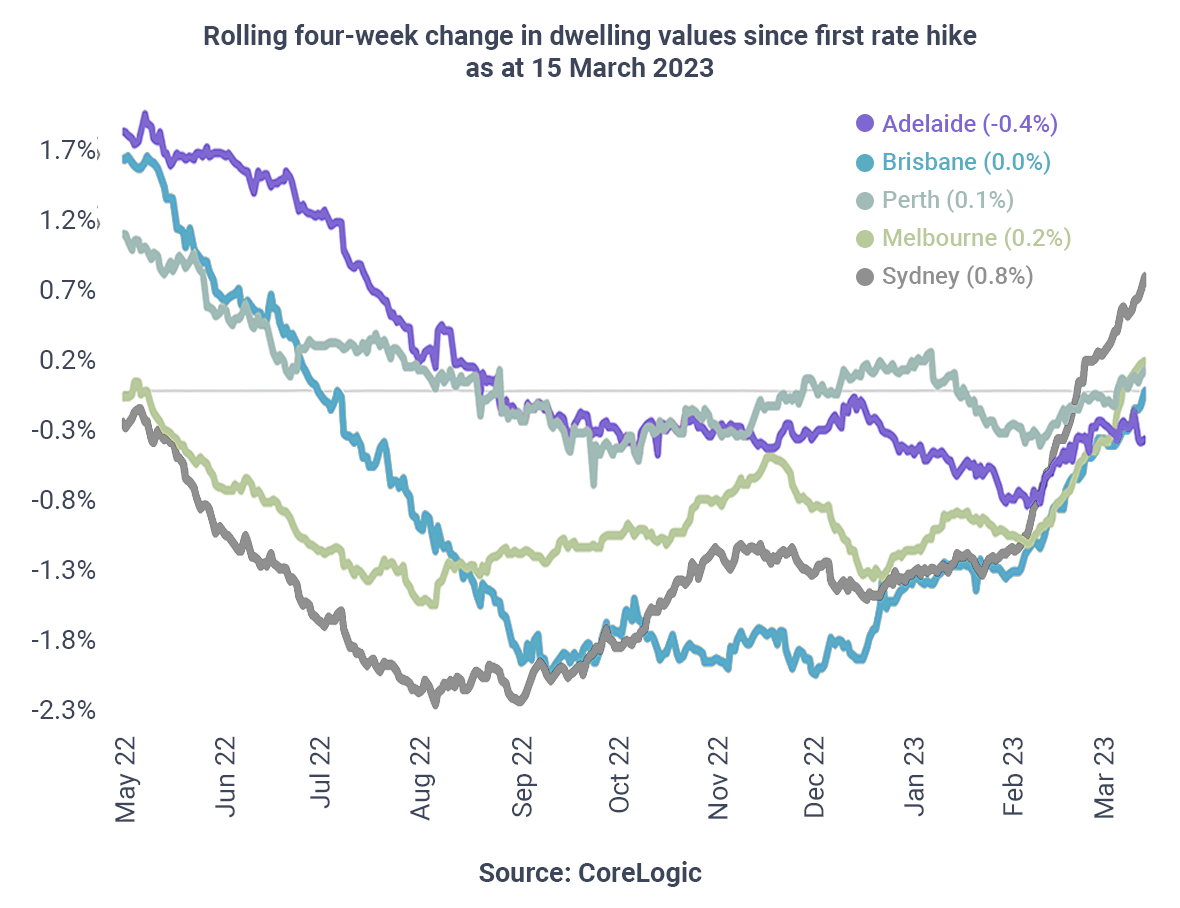

With all the talk of a housing downturn, you may be surprised to learn that prices have been going up in some markets.

Over the four weeks to March 15, the median property price rose by 0.8% in Sydney, 0.2% in Melbourne and 0.1% in Perth, according to CoreLogic. Values were unchanged in Brisbane and fell by 0.4% in Adelaide.

CoreLogic executive research director Tim Lawless identified two factors that have contributed to the change in market conditions.

First, relatively few properties are being listed for sale. “Such low advertised supply is likely to be a central factor keeping a floor under housing prices despite a clear drop in demand,” he said.

Second, increasing migration is bolstering demand. “While most of the housing demand from overseas migration is likely to flow into the rental market, with vacancy rates so tight, we may be seeing a higher than normal portion of long-term or permanent migrants choosing to buy rather than rent,” he said.

Mr Lawless said it’s too early to call the bottom of the market, because prices may fall further if interest rates keep rising or a lot of new stock gets listed for sale.

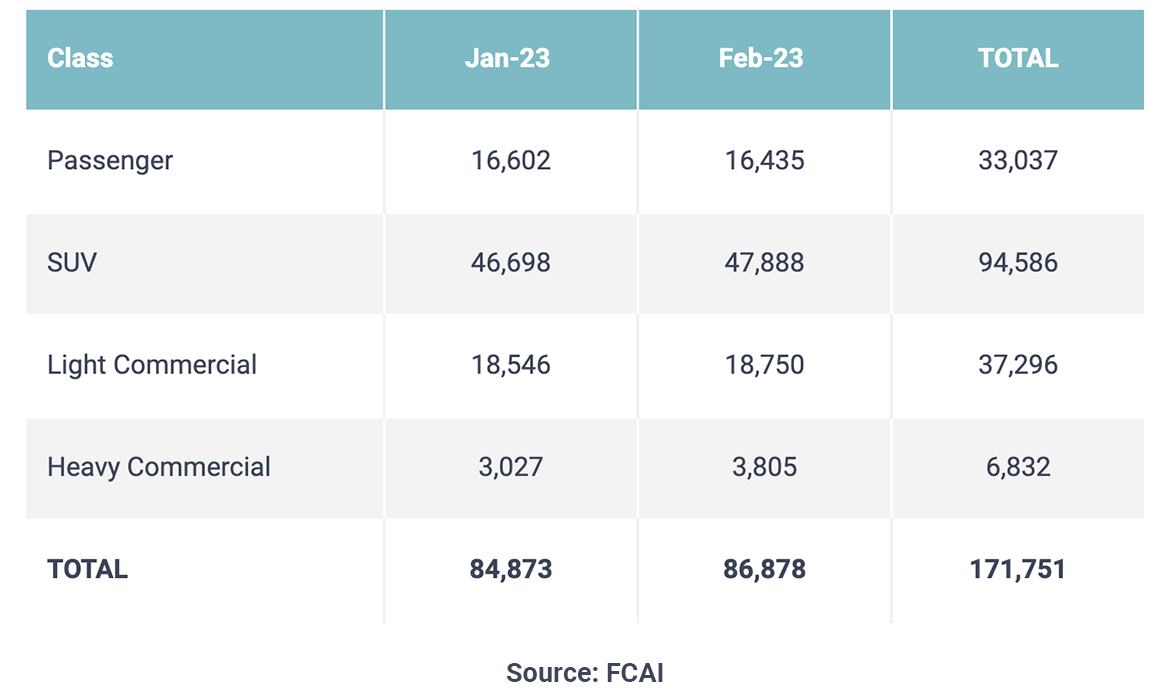

Australians are buying an increasing number of cars, SUVs, vans and trucks, with ‘green’ vehicles now representing about one in every seven purchases.

Consumers bought 86,878 new vehicles in February, which was 1.8% higher than the year before, according to the Federal Chamber of Automotive Industries (FCAI).

“This is the best February result since 2019,” FCAI chief executive Tony Weber said. “It is particularly pleasing given global and domestic supply constraints.”

Zero- and low-emission vehicles – which include battery electric, hybrid and plug-in hybrid vehicles – accounted for 13.9% of all sales in February.

“The number of low emission vehicle sales demonstrates that there is an appetite among Australians for environmentally friendly vehicles. However, if we wish to accelerate this transition to a broader range of consumers in all parts of the country, Australia needs to adopt a fuel efficiency standard,” Mr Weber said.

The five most popular brands in February were:

– Toyota – 16% of all new vehicle sales.

– Mazda – 9%.

– Ford – 7%.

– Kia – 7%.

– Hyundai – 6%.

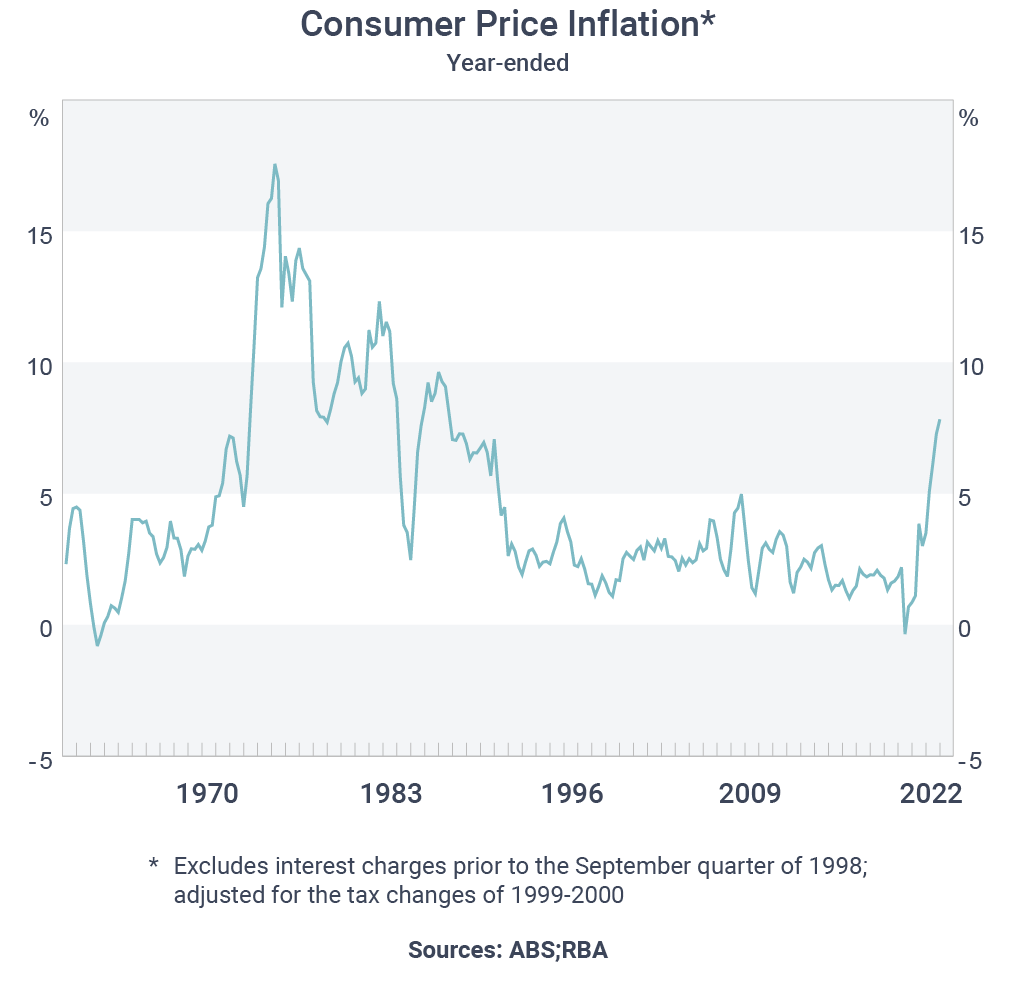

The governor of the Reserve Bank of Australia (RBA) has signalled that while the RBA is likely to raise the cash rate further, there may not be much more monetary policy tightening to come.

Speaking after the RBA raised the cash rate for the 10th consecutive time, Philip Lowe said the RBA board had to strike a balance between tightening too much (which might damage the economy) or tightening too little (which might allow inflation to persist).

“Our judgement, though, remains that further tightening of monetary policy is likely to be required to bring inflation back to target within a reasonable timeframe. Inflation is still too high [7.4%] and while it looks to be on a declining path it is likely to remain higher than target [2-3%] for a few years,” he said.

However, Governor Lowe also said the RBA board was aware that interest rates had risen significantly since 2022 and that those rate rises had caused pain for many households.

“We also discussed that, with monetary policy now in restrictive territory, we are closer to the point where it will be appropriate to pause interest rate increases to allow more time to assess the state of the economy,” he said.

PS in the media recently, economists for some of the major financial institutions have had their say as well. One said there is unlikely to be any more rate increases while another doubled down on the RBA’s view of further rate increases. In other words, nobody really knows for certain!