As the year winds down, the spotlight remains on Australian mortgage trends and their impact on borrowers navigating rising interest rates. From government initiatives addressing housing affordability to insights into the property market and business lending preferences, there’s plenty to unpack. Dive into the latest updates to stay informed and make smarter financial decisions.

Christmas is just around the corner, so if you haven’t done your shopping it might be wise to start now. In the meantime, here are four stories I think you’ll like:

– Borrowers pass their ‘rate buffer’

– Govt tackles housing affordability

– Australian property earns praise

– ABS releases good economic news

Read more below.

And for the business owners amongst you,

we have snuck in the results of our most recent survey (towards the end 😉)

This month’s survey question:

If you were borrowing money for your business, would you…..

- use your transaction bank

- a specialist lender

- a broker

(Scroll to the end to see the results – and our commentary!)

Plus…..

Updated Regional Property Reports

Here are the last 3 months’ updates of these detailed regional reports (including the property clock: Buy / Hold / Sell).

There are 30+ regions analysed and they are updated regularly.

Request FREE Report

The mortgage market has entered interesting territory, thanks to the Reserve Bank’s decision to hike the cash rate by another 0.25 percentage points in November.

That increased the rate rises that have occurred since May from a cumulative 2.50 percentage points to 2.75 percentage points.

The reason that’s significant is because when lenders assess home loan applications, they have to make sure the borrower could repay the loan if interest rates were to rise.

Until October 2021, lenders had to add a buffer of at least 2.50 percentage points – so the November rate rise pushed many borrowers beyond their buffer.

Since October 2021, that buffer has increased to at least 3.00 percentage points

But despite the series of rate rises, CoreLogic isn’t seeing any signs of panicked selling or forced sales in its listings data.

“In fact, the flow of new listings remains substantially below what they would usually be for this time of the year,” executive research director Tim Lawless said.

Reach out if you’d like to discuss refinancing. I can explain the pros and cons, and potentially help you refinance to a comparable loan with a lower interest rate.

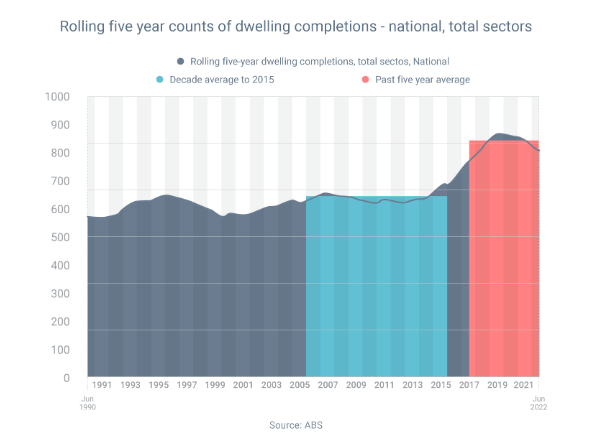

One of the highest-profile elements of the Albanese government’s first budget was a target to “build one million new well-located homes over five years from 2024”.

Only 2% of these one million new builds will be funded by the federal, state and territory governments; the other 98% will come from the market, with governments “playing a key role in enabling and kick-starting investment”.

CoreLogic’s head of residential research, Eliza Owen, noted that some have said the target lacks ambition, given that 974,732 homes were constructed in the five years to June 2022, and an average of 1,010,723 have been completed on a five-year basis since 2017.

One of the highest-profile elements of the Albanese government’s first budget was a target to “build one million new well-located homes over five years from 2024”.

Only 2% of these one million new builds will be funded by the federal, state and territory governments; the other 98% will come from the market, with governments “playing a key role in enabling and kick-starting investment”.

CoreLogic’s head of residential research, Eliza Owen, noted that some have said the target lacks ambition, given that 974,732 homes were constructed in the five years to June 2022, and an average of 1,010,723 have been completed on a five-year basis since 2017.

“However, the past five years have been conducive to high levels of construction (notwithstanding immense bottlenecks for the construction industry in the past two years) and there’s no guarantee activity levels will remain at the same level for the next five years,” she said.

“As interest rates rise, home prices fall and supply-side constraints persist, the delivery of a million homes is not guaranteed and may be more ambitious than what was achieved in the past five years.”

Australia’s population is set to grow strongly over the next decade, which is likely to lead to higher demand for rental accommodation.

Global real estate giant CBRE said population growth is one of the main reasons why “Australian real estate represents a compelling investment”.

CBRE said Australia’s population was expected to grow by 14% between 2021-2030, which would be the highest rate among developed economies.

That strong population growth is partly due to migration, with the federal government recently increasing its annual permanent migration intake from 160,000 people to a record 195,000.

More competition for rental accommodation would put upward pressure on rents, in an environment that’s already strongly favouring landlords. As CBRE noted, there is “less than 1% vacancy in select markets”, which is leading to “robust rent growth”.

CBRE forecasts that from 2022-26, rents will increase by an average of at least 5% per annum in Sydney, Melbourne, Brisbane, Perth and Adelaide.

Australia’s economy has posted its best growth numbers in a decade, according to the most recent data from the Australian Bureau of Statistics.

The economy grew 3.6% in the 2021-22 financial year – the best result since it grew 3.9% in 2011-12.

That strong economic growth has helped drive down the unemployment rate to below 4%, which is very low. As a result, the vast majority of workers have jobs, which is the key to being financially secure.

The ABS also reported that households saved 13% of their income in the 2021-22 financial year, which is high by historical standards.

That means many people put money aside for a rainy day – a smart move given the subsequent increase in prices and interest rates.

The Reserve Bank said earlier this month that it “expects to increase interest rates further over the period ahead”, so if you have a home loan, it would be wise to budget accordingly.

Two possible ways to save money are to ask your bank for a rate cut (you’d be surprised how often they agree to this) or to refinance to a comparable loan with a lower interest rate.

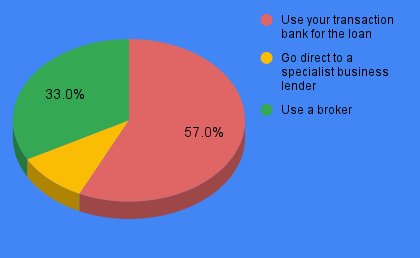

This month’s survey results are in!

If you were borrowing money for your business, would you…..

The interesting thing here is that whilst 70% of borrowers consider using a broker for their residential property loan, business owners still prefer to use their bank.

This is interesting for a few reasons:

– Transaction banks are not always the best solution for business finance. That is why there has been a proliferation in the growth of non-bank lender finance for businesses.

– Using property security for business purposes may work when there is an asset being acquired and the asset is the property which is being used as security.

– However, for other business purposes e.g. working capital finance, cashflow finance, ‘urgent cash’ finance and debt consolidation finance, other types of security might work better – particularly in terms of turnaround time and flexibility of the amount able to be borrowed.

– There are now non-bank lenders offering not just invoice finance (commonly referred to as debtor finance or factoring) but also trade finance where the supplier’s invoices are financed so the supplier remains happy as they are being paid on time. This can be particularly relevant for purchases from overseas suppliers who don’t like to ship their stock if they haven’t guaranteed payment is going to be received.

– Sometimes (e.g. for a property acquisition), the business owner is using the business entity to hold the asset. However, the assets can be held in other entities which might be more appropriate eg a super fund, or a trust. Typically, we see good tax accountants assist business owners make this assessment.

We can help you work out the best way to fund the cash your business needs in order to grow. And, as a broker, we can introduce you to the lender which will best suit the needs of your business.

–

Check our latest blogs below!

Or book a call with me!