If you like keeping up to date with what’s happening with property, finance, cars and the economy, you won’t want to miss this newsletter. Here are four big stories:

– Govt plans RBA cash rate reform.

– HomeBuilder deadline extended.

– Cars to become more efficient.

– Inflation continues falling

With inflation falling, it’s good to see that the mortgage holders’ heavy-lifting is paying dividends for the entire community!

Read more below.

But first, our regular clockwork property updates!

There has been a whole lot going on – (and I won’t even go into my kids, school camps, cross country, and of course the onset of a chilly start to winter – I wish there was a ‘green’ log fire option).

Lender’s Carrots

A slightly unusual carrot – a survey from our friends at Banjo Loans. Banjo did a survey of small to medium businesses (SMEs) and came up with some interesting data and observations. Whilst particularly relevant for brokers and accountants, it also has some insights into how business owners are viewing the next year or so. Click the link below to obtain access to this report.

Your copy of Banjo Loans’ SME report

Client Story

An unusual one…..

A financial planner had a 70-year-old couple as clients. They had their funds tied up in a property investment fund and they needed cash to enable settlement for their retirement home. There are loan products for the ‘over 65’s’ such as reverse mortgages but in this case, these products could not be used.

However, there was a product which came to the rescue. It is basically an equity release product and is normally used for those who need cash prior to settlement from the sale of their home (i.e. asset rich cash poor). The beauty of this product is there is no repayments or interest payments to be made until settlement.

After discussions with the lender we ‘manufactured’ a solution for our clients using this product – resulting in a happy couple and a happy financial planner!

If you have an interesting loan scenario and require an innovative solution, reach out, and let’s chat.

Interesting Loan Scenarios – reach out!

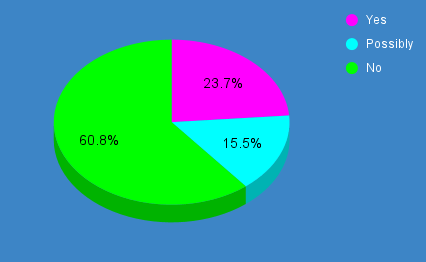

Our survey results are in!

Our question was:

If you were to sell a property, would you use a vendor advocate?

Some observations:

– I suspect a lot of people have heard about Buyer Advocates and Investment Property Advisors but the purpose and use of Vendor Advocates is not as well known.

– Vendor Advocates help you choose the right real estate agent (REA) to sell your property. They are often remunerated via a commission split with the real estate agent selected.

– Their job is to make sure your selected REA does all the things they should be doing when selling your property. I am not sure about you, but when I have sold a property, I have basically let the sales agent do what they do and all I have done is get weekly reports and updates. I try to be useful but to be realistic, my knowledge is much less than the agent’s knowledge so I am often of not much value.

– A good Vendor Advocate can do a number of things: Apart from making sure you are selecting the right agent to sell your property, they earn their keep (and their reputation) by adding value to your sale and making sure your agent goes the full nine yards when selling your property.

– A good Vendors Advocate is well-versed in the real estate sales process so they know what questions to ask on your behalf and they know what is going on in the market from their regular discussions with agents in your area.

– But, like any service provider you always want a good one! I have a number of Vendor Advocates who I have spoken to and they want to make sure they are seen as adding value for their clients. After all, referrals from their happy clients is often their best form of marketing.

Find out more about Vendor Advocates

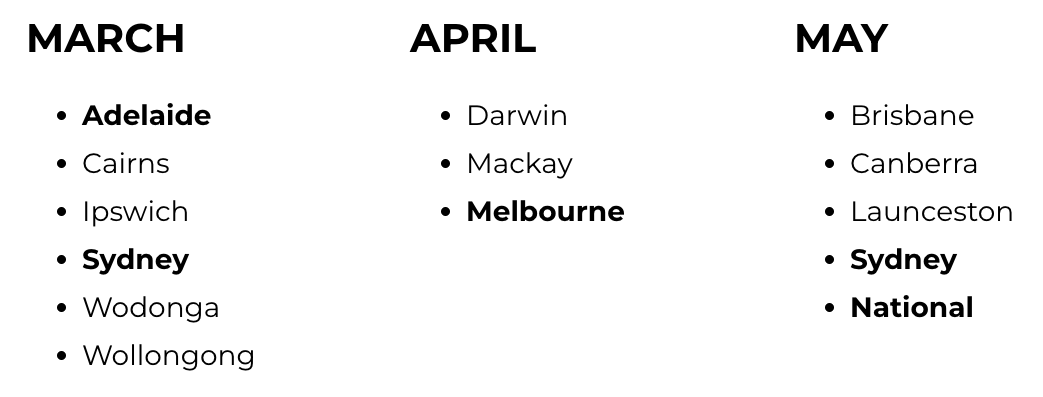

Regional Property Report Updates

For investors, this is a bonanza offering for those regions around Australia you are not familiar with. The level of detail and research is ‘second to none’ so delve into them before making your next property investment decision.

And, if you don’t have a property investment advisor, do yourself a HUGE favour and make sure you use one. I have quite a few seasoned professionals who can assist you (including the authors of the Regional Property Reports referred to above), so I can certainly put you in contact with someone who can make your next buying decision a better one.

And remember, your BIGGEST cost of your next property purchase is the opportunity cost of choosing the wrong property. A 2% to 3% inferior annual return adds up to big $$$ over 5 to 10 years.

You can access over 30 Regional Property Market analyses. Many of these Reports have over 50 pages of detailed information including whether to consider to Buy, Hold or Sell.

The regions cover all capital cities plus regional cities across Australia.

The last 3 months updated Reports:

Click here for access to our Regional Reports

Government plans to reform how RBA sets cash rate

Treasurer Jim Chalmers has accepted all 51 recommendations put forward by a federal government-commissioned review of the Reserve Bank of Australia (RBA).

As part of the proposed changes, legislation will be introduced by Dr. Chalmers to establish two separate boards—one for overseeing monetary policy, including the setting of the cash rate, and another for managing the Reserve Bank’s internal governance.

Furthermore, the RBA will be granted a new mandate that emphasizes the pursuit of “economic prosperity and welfare of the people of Australia now and in the future” as its overarching purpose, rather than treating it as a distinct objective solely for monetary policy.

Treasurer Chalmers emphasized the importance of having the most effective central bank and monetary policy framework to address current and future economic challenges.

He noted the positive reputation and high-quality staff of the RBA, acknowledging its past contributions to Australia’s economic outcomes. However, the review identified various opportunities for strengthening the country’s monetary policy framework over the last three decades.

HomeBuilder documentation extended to 2025

Under a new initiative from the federal government, applicants for the HomeBuilder incentive have been granted a two-year extension.

Initially, the deadline for applications was on 14 April 2021, with a subsequent deadline of 30 April 2023 for submitting supporting documentation. However, this deadline has now been further extended to 30 June 2025, but its applicability depends on the acceptance of this change by individual states or territories.

The purpose of this extension is to provide support to individuals who made financial commitments with the expectation of receiving the HomeBuilder grant but faced challenges due to supply constraints and delays in the construction industry.

“I thank states and territories for their feedback on the Government’s proposed extension and the updated data they have provided on outstanding, existing HomeBuilder applications,” Minister for Housing Julie Collins said.

Car manufacturers told to lift their game on fuel efficiency

In an effort to enhance fuel efficiency, the federal government has initiated the process by releasing a consultation paper and inviting public input.

Fuel efficiency standards necessitate that global vehicle manufacturers, as well as their local suppliers, progressively enhance the average fuel efficiency of new cars.

Minister for Transport Catherine King and Minister for Climate Change and Energy Chris Bowen noted that Australia is among the few developed nations that do not currently have fuel efficiency standards in place. Consequently, there is no obligation for global vehicle manufacturers to introduce their most advanced fuel-saving technologies to the Australian market, including high-efficiency internal combustion engine technology, hybrids, and electric vehicles (EVs).

“With a fuel efficiency standard in place, Australians can expect to continue to access the same types of vehicles they do currently, from hatches to 4-wheel drives, utes to vans and everything in between. But they will also get the choice of more efficient petrol and diesel engines, more hybrids, plug-in hybrids and battery EV options available for sale.”

Once the consultation period is over, the government will develop a model for a fuel efficiency standard and then introduce legislation to parliament.

Get in touch if you need a car loan

Inflation falls for third consecutive month

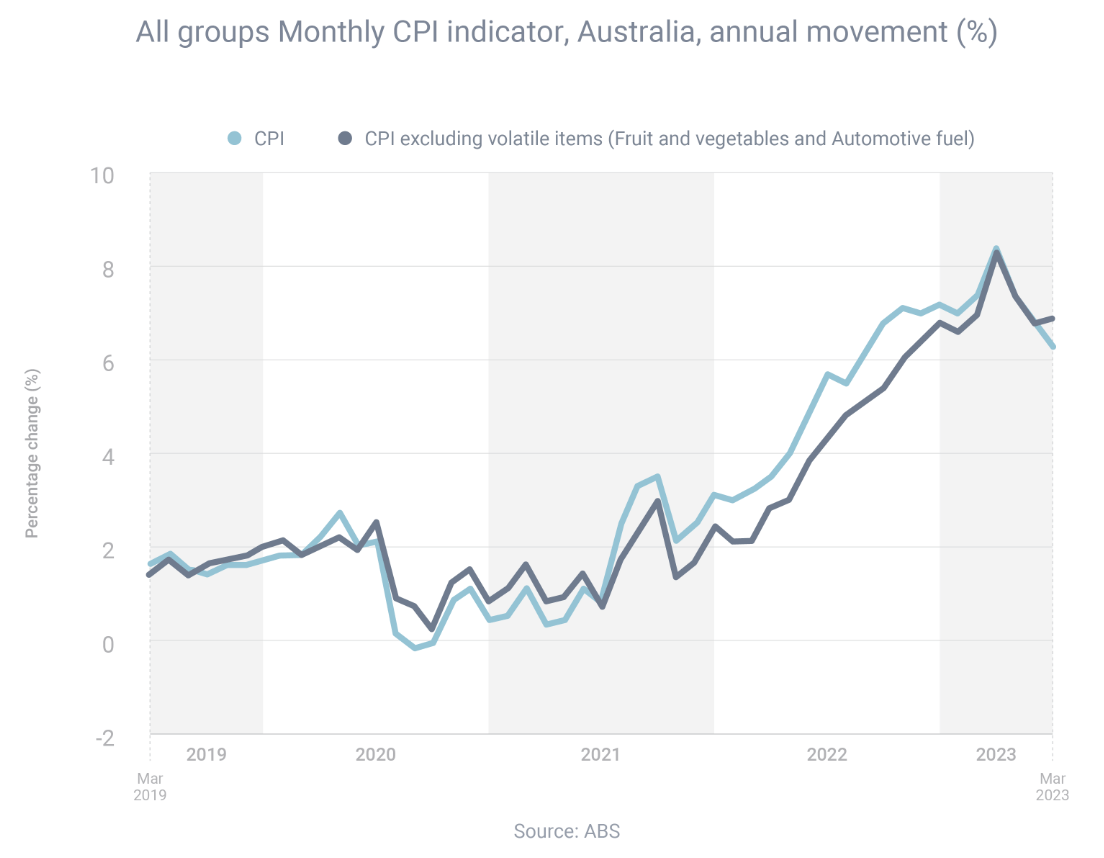

Consumers can find encouragement in the recent trends indicating a decline in inflation, suggesting that it may have reached its peak last year.

According to the Australian Bureau of Statistics, inflation reached a high of 8.4% in December. However, it subsequently decreased to 7.4% in January, further declining to 6.8% in February, and reaching 6.3% in March.

It is important to note that the mentioned inflation reading represents an average, implying that not every product or product category experienced a price increase of 6.3%.

Inflation ranged from 0.8% for transport to 9.5% for housing, while prices also rose 3.2% for clothing & footwear, 6.6% for insurance & financial services and 8.1% for food & non-alcoholic beverages.

The Reserve Bank has forecast that inflation will fall to 4% by the end of this year, 3.25% by the end of next year and 3% by the end of 2025.