Hi,

As summer comes to an end, the property market tends to kick into gear. There’s a lot of real estate news around right now, including these four big stories:

– Building approvals trending down.

– Rents rise as vacancies fall.

– Real estate price update.

– Australia sets a refinancing record.

Read more below.

But first….

Some things you might like to know!

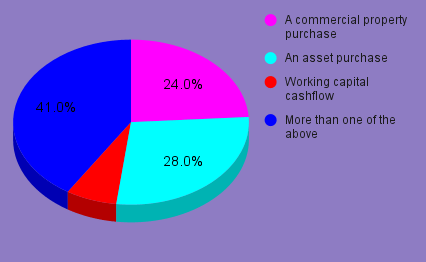

– The results of our new poll are out! Our question was: As a business owner, the main reason I would borrow money is for..

– We have 5 more updates for our regional property reports. The last 3 months of updates are set out below.

– Our 5 suburb comparison report is great for buyers looking to buy in a specific area when they are not 100% sure which suburb to buy in. And as we know, property prices and trends can often vary significantly between neighbouring suburbs. Click the link below to find out what you might not know.

#1 Our survey results are in!

Our question was: As a business owner, the main reason I would borrow money is for..

– A commercial property purchase

– An asset purchase

– Working capital cashflow

– More than one of the above

Some observations:

– Interestingly, most business owners are not seeing much need for cashflow borrowing. Despite this, there are now a number of lenders who operate in this space and they are finding there is strong demand. I wonder if there is a disconnect on this type of funding or perhaps it is still a small but growing niche.

– I am not surprised that asset purchases and commercial property purchases are the main reasons for borrowing. Large, lumpy capital requirements are always a good reason to borrow; the logic being that the cost of funds is offset by either capital growth and rental savings (commercial property) or profit generation (asset purchase) – the exception to the latter being a new Porche for the Business Owner 😂

– Although the survey was unable to untangle the ‘multi-purpose’ loan requirements, I am guessing that, in the absence of any other data, this would reflect the proportion of loans in the other 3 categories.

– Unlike home loans where brokers complete over 70% of the loan transactions, in the business space, only 25% of loans are written by brokers. So for borrowers and brokers, there are a lot of opportunities to ‘do better’. For borrowers, they may not necessarily be getting the best and most suitable product for their business and for brokers who have the skills to understand business operations and business structures, there are lots of opportunities for growth.

– If you have a business or you know of someone who has a business, we would love to assist them getting the most suitable deal for them and their business. We are currently organising funding for a commercial property refinance, a large working capital loan as well as a couple of construction builds in the commercial and residential space. Please make time to have a chat by clicking the link below.

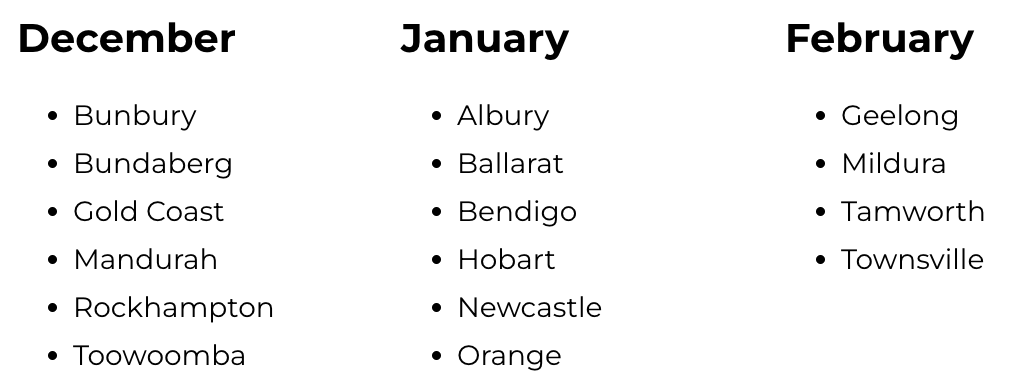

#2 Updates to our Property Market Reports.

These Reports are a great resource for those looking to buy in a new region or just to get a feel for what is happening in that region. Each Report also includes a suggested recommendation to Buy / Hold / Sell.

Updated Regional Property Reports

Here are the last 3 months’ updates of these detailed regional reports (including the property clock: Buy / Hold / Sell).

There are 30+ regions analysed and they are updated regularly.

Get your Free Property & Regional Reports!

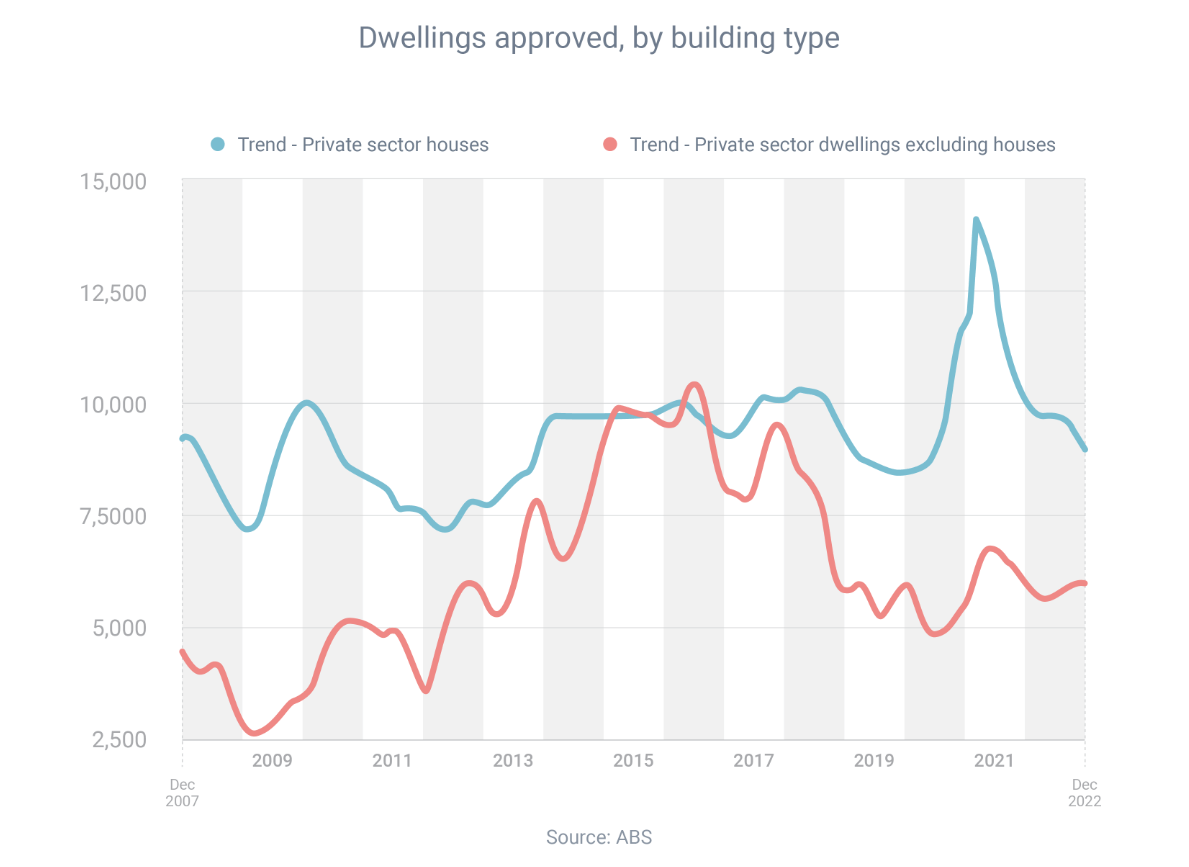

The number of new homes that will be built in the coming years appears to be falling, judging by the latest data from the Australian Bureau of Statistics.

Fewer building approvals were issued in 2022 than 2021, for both houses and other dwellings (which are mainly apartments, but also include townhouses, semi-detached houses and row or terrace houses):

– Approvals to build houses = fell from 145,833 in 2021 to 114,179 in 2022.

– Approvals to build other dwellings = fell from 77,096 in 2021 to 70,062 in 2022.

There’s usually a lag of several months, and sometimes several years, between when an approval is issued and construction begins. And, sometimes, construction never begins at all, because the individual or developer decides not to proceed with the project. However, it’s likely that the reduction in approval numbers in 2022 will translate to a reduction in home building activity in the coming years.

Would you like to build a new home, either to live in or for investment purposes? If so, get in touch and I’ll be happy to explain how construction finance works, and the difference between a construction loan and a regular home loan.

Need a construction loan? Let’s talk!

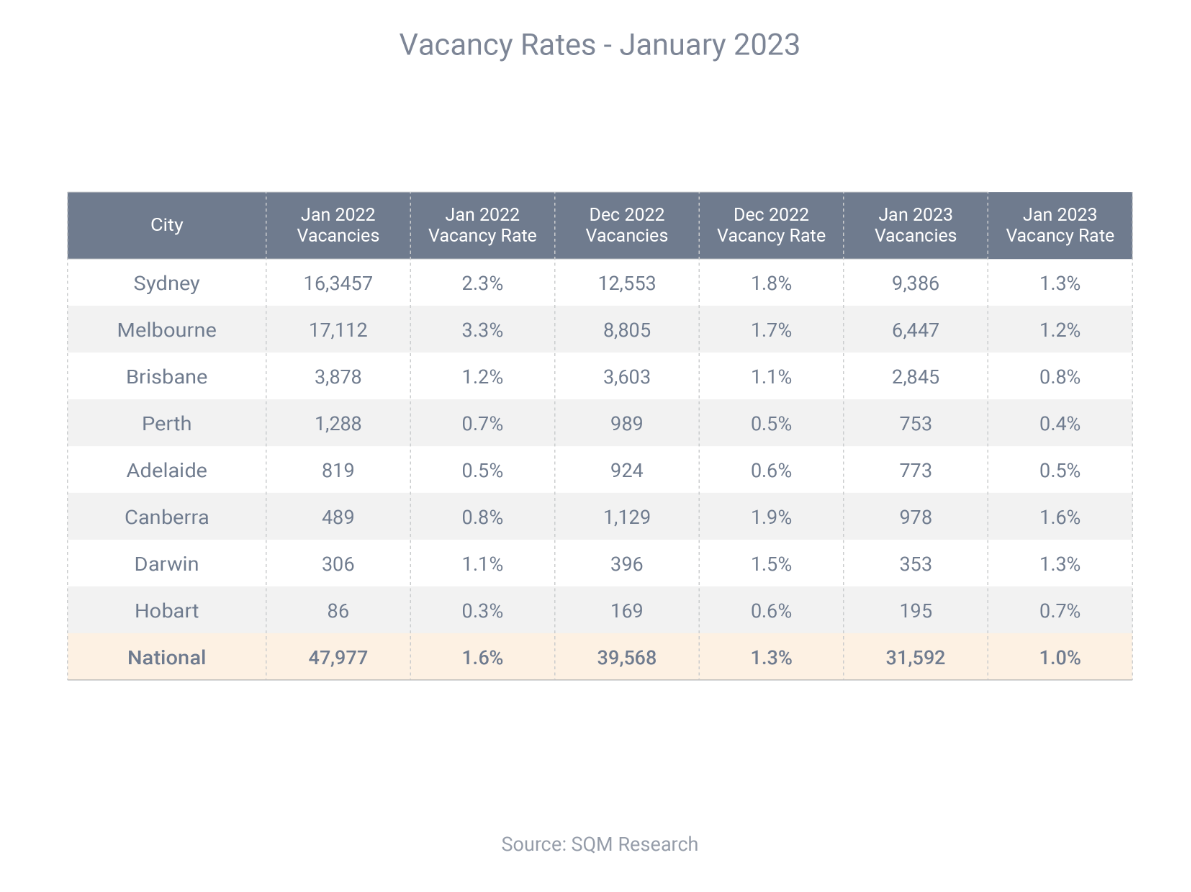

Property investors are enjoying strong growth in rents, thanks to the severe shortage of rental properties.

Across Australia, just 1.0% of rental properties were vacant in January, according to SQM Research. That was down from 1.6% the year before.

The reduction in rental supply has led to an increase in demand, which in turn has made tenants more willing to pay higher rents.

Asking rents jumped by a remarkable 17.4% in the year to February 12, according to SQM.

Vacancy rates are low and rents are rising in many parts of Australia, which means now might be a good time to buy an investment property.

Reach out if you’d like to discover your borrowing capacity and discuss how you could finance a potential purchase.

Get in touch if you need an investment loan!

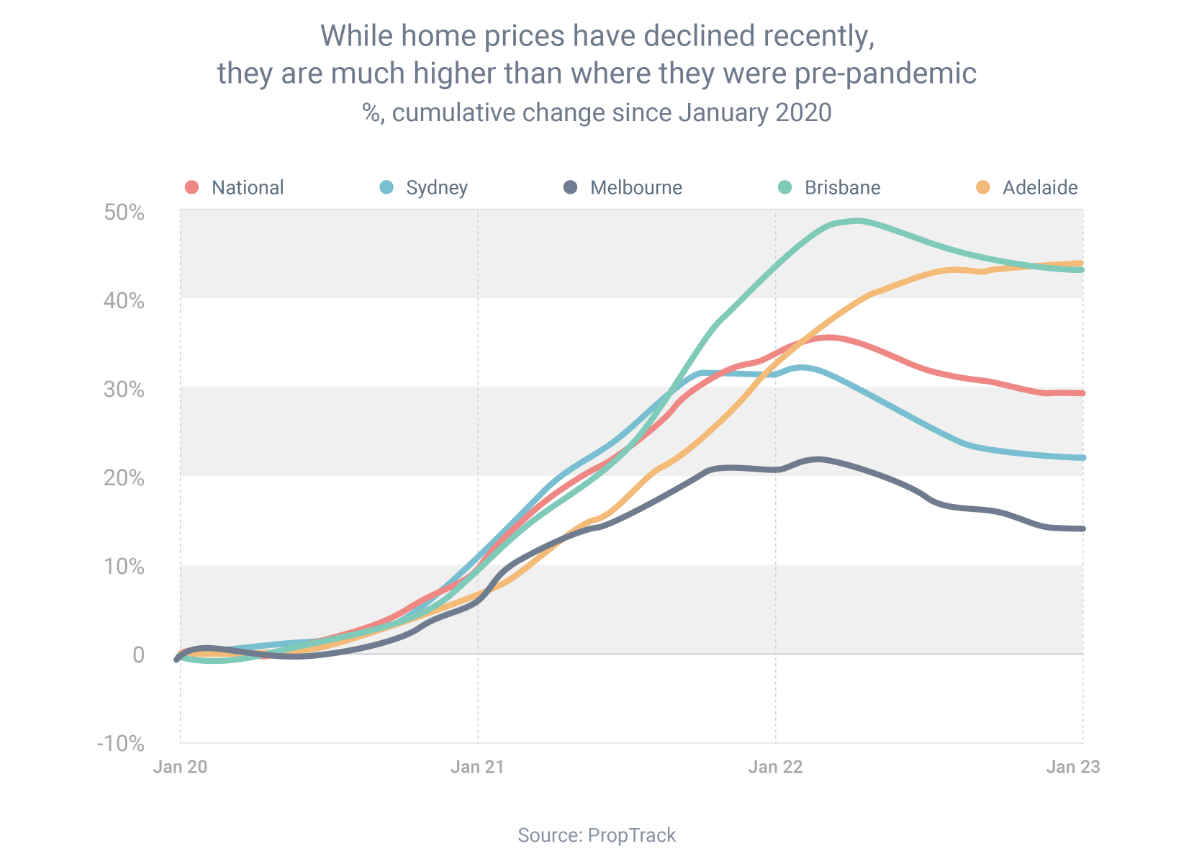

In the case of the Australian property market, what goes up tends to go down less.

History shows there are periods when prices rise, as occurred from late 2020 to early 2022, and periods when prices decline, as has occurred over the past year or so. But, over the long-term, the increases have tended to far outweigh the decreases.

That’s reflected in new data from PropTrack, which compared property prices in January 2023 with prices just before the pandemic, in January 2020.

Across Australia, prices were 29.4% higher in January 2023 than January 2020.

PropTrack economist Angus Moore said that while recent price falls “are not insignificant”, they are occurring after an extraordinary boom, with 2021 being the third-fastest year of national price growth on record.

“While anyone that bought near the peak in 2022 has probably seen their home value fall relative to when they bought, most homeowners aren’t in that boat. That’s because the vast majority of Australians bought before that peak,” he said.

Reach out if you want to buy a property!

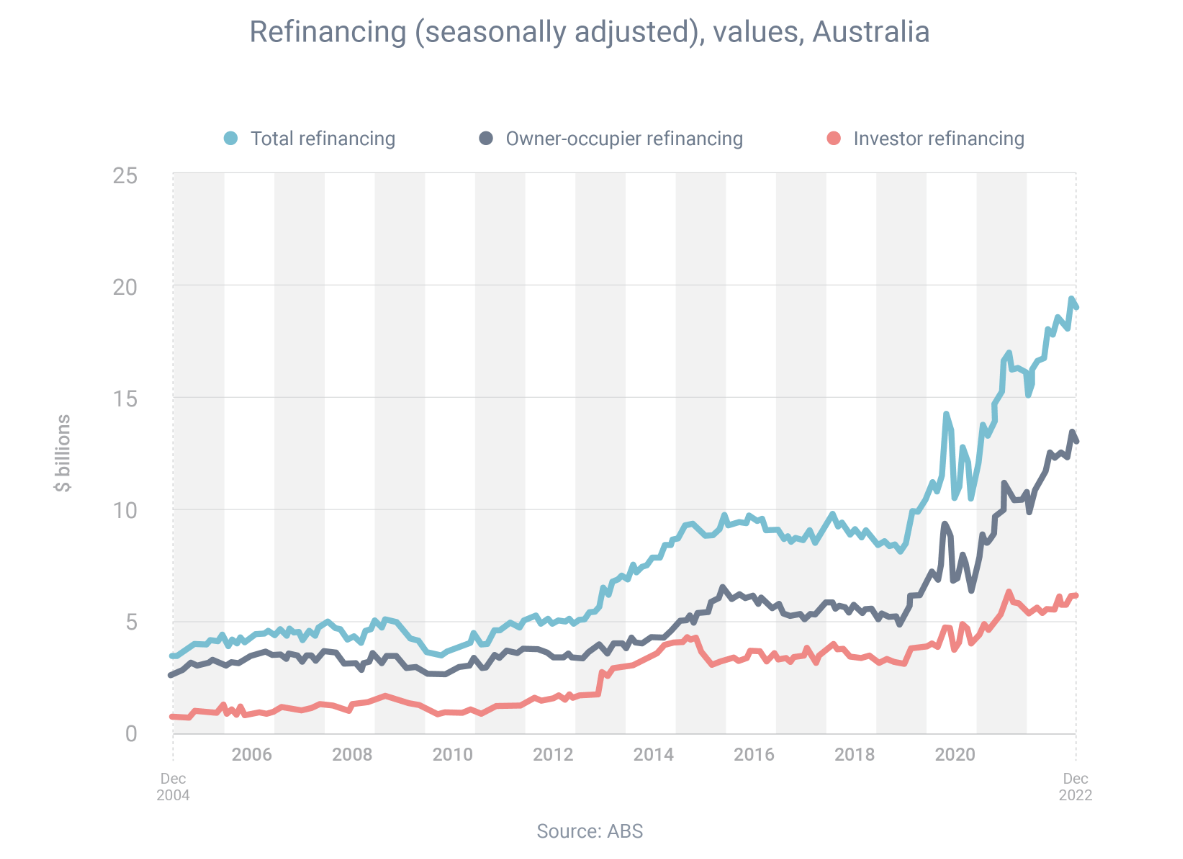

Home owners have been doing an extraordinary amount of refinancing since the Reserve Bank began raising the cash rate in May 2022.

The eight months from May to December included the eight biggest months in refinancing history, according to the latest data from the Australian Bureau of Statistics.

That included $19.4 billion of refinancing in November, the biggest month on record, followed by another $19.1 billion in December, the second-biggest month.

Lenders compete fiercely for business, so they often charge lower interest rates for new customers than existing customers.

That’s why it’s possible to score a significant rate reduction by switching lenders.

Even better, some lenders are offering cashback deals of several thousand dollars to people who refinance.

Refinancing comes with pros and cons, so it’s important to do your research and crunch the numbers before switching lenders.

I can help. Get in touch and I’ll talk you through your options, so you can find out how much you could save by refinancing and whether it’s right for you.