Looking to save this Easter? Check out these smart borrowing tips to reduce your loan interest and keep your budget intact with a simple adjustment to your repayment strategy and offset account use.

So, let’s show you how to save some serious moula for Easter! (PS learning lesson for today: Moula is (apparently), French for ‘money’ but it is spelled in all sorts of ways as a slang term for money – moolah moola, mula – take your pick!).

Last month, I gave you a few short client stories (we love to help our clients save money!).

This week…..

A question from the floor…..

Should I change my loan repayment frequency?

Brokers love this topic as they can sound like an expert by showing you how much you can save by making weekly payments Vs fortnightly Vs monthly payments. Calculators and Excel worksheets at the ready! Let’s go!

Let me give you the real story….

And let’s keep it simple: If you have spare funds and you are NOT using an Offset account feature (or the Redraw feature) then you are probably paying too much interest.

Unless there are really good reasons not to do so, I recommend my clients consider selecting an Offset account feature.

This way, they automatically reduce the balance of their loan which a lender is using to calculate their interest payments. (Lenders only calculate daily interest on the balance of your loan less the balance of your Offset account).

So stop worrying about repayment frequency and just put all your spare moula into your offset account – and have your salary credits sent directly to your Offset account. Even if your salary sits there for just a few days (before you buy those yummy Easter choccies 🤣), you will save in interest.

And if you are a bit of a spendthrift, park your surplus funds in your Redraw facility – it’s harder to access than your Offset!

Ps this is one of the things I cover in my new e-book Smart Borrowing 101: Become a pro and beat the banks at their own game (you can order your own copy via the link below:

Did you see our March Magnifico Cashback Offer email (sent out last week)? 3 lucky clients have signed up so there are now 7 places remaining!

In short, BIR Finance will pay you up to $800 – $350 on settlement and up to $150 each year for 3 years.

Full details are set out below:

The devil is in the detail and conditions apply but if you would like to be one of those selected, BOOK YOUR CALL!

There’s no denying that home loan volumes, buyer activity and property prices are rising in many parts of the country. That’s why these four stories are so topical:

- Home loans rise 11.7%.

- Is now a good time to buy?

- Prices keep increasing.

- Deposit hurdle doubles.

Read more below.

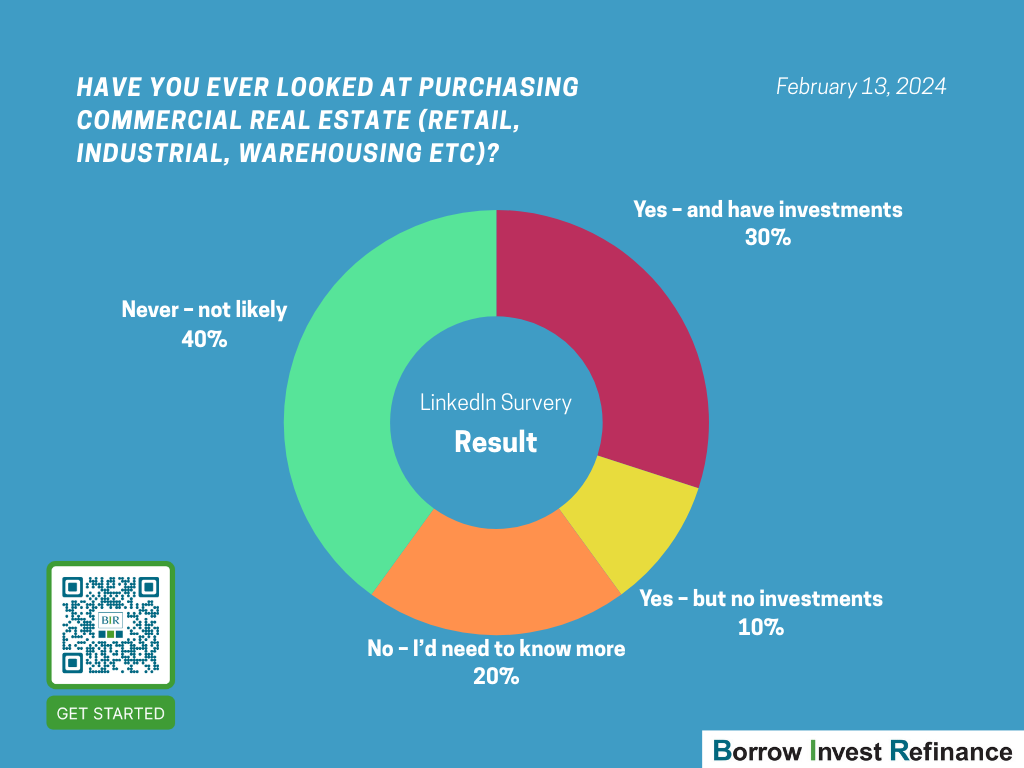

Our latest survey results are in!

I have had a discussion with Chris Chan, a Commercial Property Buyers Advocate recently – more on Chris in a later newsletter, but he had some interesting things to say about commercial real estate for investors. Some of the things he mentioned over a coffee in Port Melbourne:

- The tenant pays for everything – unlike a residential tenant who only pays the rent.

- There is not much to go wrong in a commercial property so repairs and maintenance costs are low as you are often renting out 4 blank walls with the tenant providing the fitout and doing any repairs to their fitout.

- When the tenant departs the property, they are required to pay a ‘make good’ amount to leave the property in the same conditiion they found it.

- The landlord is not subject to the State laws which govern how a residential landlord has to treat their tenants.

- The lease terms are long (with options) and there are inflation Vs market rate adjustment clauses for the rent amount so no haggling and no stand-offs.

In a later newsletter, I will give an update on Chris and his business. As someone who has specialised as a site selection specialist, he comes to commercial property with a different skill set than many commercial property buyer advocates.

Property Clock Update

Hey investors, the market’s getting hotter!

Don’t miss out on this amazing chance spanning over 30 regions in Australia. Make sure to check them out before deciding on your next property investment.

Quick heads up: Your biggest loss could be your Opportunity Cost.

When it comes to your upcoming property purchase, choosing the wrong one could cost you big time.

For instance, a 2% annual return difference (5% versus 7%) on a $500K property investment means you’re looking at a $63K drop in capital gain over 5 years and $179K over 10 years.

The solution?

Get in touch with a reliable property investment advisor. We’ve got connections to advisors who offer tailored, well-researched options to suit your needs.

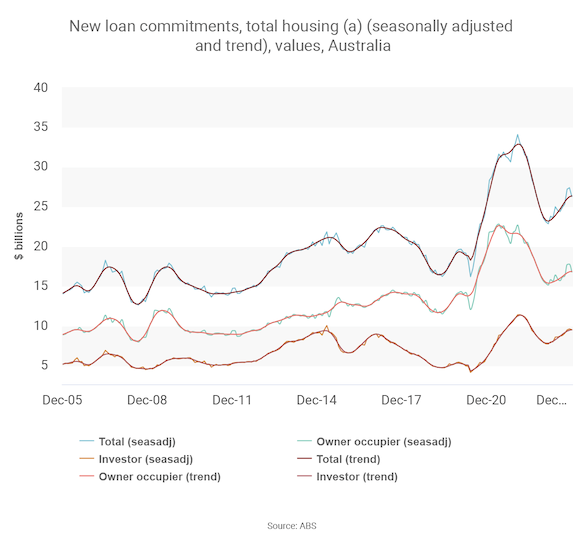

The latest lending data show a big year-on-year increase in both home loans and car loans activity.

Property buyers throughout the country committed to $26.27 billion of mortgages in December 2023, according to the latest data from the Australian Bureau of Statistics, which was 11.7% higher than the year before.

That included a 7.4% rise in owner-occupier borrowing, to $16.77 billion, and a 20.4% rise in investor borrowing, to $9.50 billion.

Meanwhile, consumers took out $1.301 billion of loans to purchase motor vehicles, which was 12.9% higher than the year before.

The increase in mortgage and car loan activity is unsurprising given that property prices are rising in many parts of the country and dealerships are selling record numbers of new vehicles.

Whether you want to finance a property purchase or a vehicle purchase, I can help. Reach out so we can discuss your scenario and I can recommend how to proceed.

Many economists believe that interest rates will start falling in late 2024, which begs the question: should you buy a property now or wait for a potential rate cut?

Domain Chief of Research & Economics Nicola Powell, said the key with property was not timing the market but time in the market.

“If I were a buyer trying to buy, then I’d be thinking it’s now much more about the property than the state of the market,” she said.

“I really believe, having pored over 30 years of housing market data, that housing markets are cyclical, and you go through lots of periods where prices rise and then fall.”

“When you’re purchasing a property, it’s for a long-term investment and you are going to ride multiple property cycles, and that’s how you build financial wealth. So if I would give any advice, it would be to buy when it’s right for you. Housing markets are complex and often impossible to predict.”

Get in touch if you believe now is the right time for you. I’ll calculate your borrowing capacity, compare home loans and manage your mortgage application.

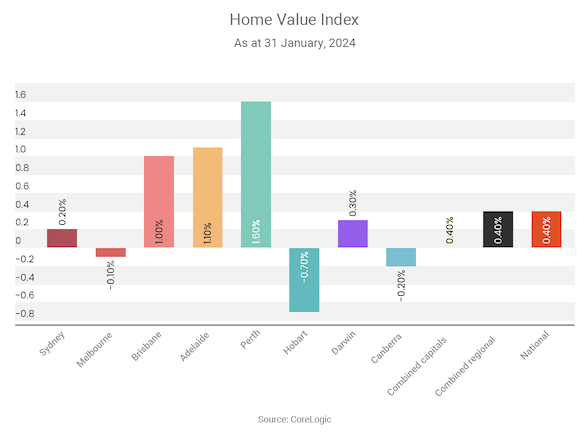

Australia’s median property price has now increased for 12 consecutive months, after rising by another 0.4% in January, according to CoreLogic.

House values continued rising at a faster rate relative to unit values in January (0.5% vs 0.2%), with the gap between the median capital city house and unit values growing to a record high of 45.2%.

“Since the commencement of the upswing, capital city house values have surged 11.0% higher while unit values are up 6.9%. It seems that most Australians are willing to pay a higher premium than ever for a detached home,” CoreLogic said.

Looking ahead, CoreLogic noted that the historic correlation between consumer confidence and homebuying activity could push prices higher.

“Although this relationship has diverged a little in 2023, which is probably attributable to high migration and unusually tight rental conditions, any lift in consumer attitudes should play out positively for housing market activity. With inflation easing and the prospect of rate cuts later this year, we should eventually see sentiment moving higher.”

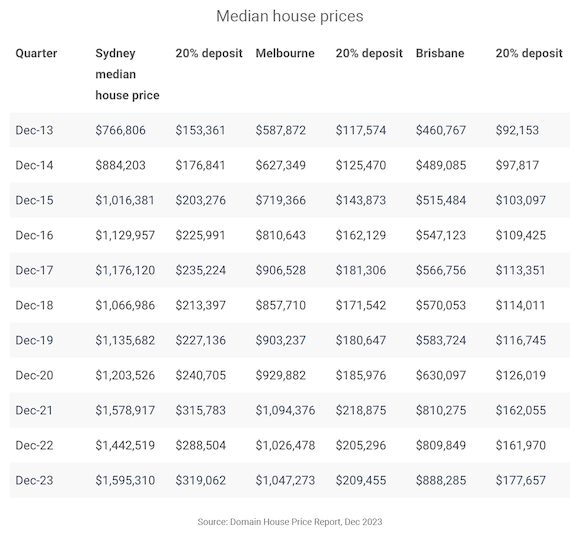

With property prices continuing to rise, deposit requirements are also increasing.

As Domain data shows, this is nothing new. For example, over the 10 years to December 2023, the amount of money required for a 20% deposit on a home valued at a particular capital city’s median price rose by 108% in Sydney, 78% in Melbourne and 93% in Brisbane.

What makes this challenging is not so much that the deposit hurdle keeps rising but that, depending on your circumstances, it might be rising faster than your capacity to save, seemingly putting homeownership further and further out of reach.

If you feel like you’re in that position, please contact me.

As a mortgage broker, one of my specialties is educating people about how they might be able to enter the market considerably faster than they realise. Some options include:

- Using a low-deposit home loan.

- Using a family guarantee home loan.

- Accessing government housing support.

- Buying with a family member, partner or close friend.

- Rentvesting.

You might be closer to buying a property than you realise.

You can also check my LinkedIn profile for more info: Michael Royal