Hi,

I hope you and your family had a great Christmas break. Even though it’s early in the year, there’s already some big news around:

– Refinancing hits new record

– Property listings rise 4.6%

– 3 key fixed-rate loan tips

Read more below.

But first….. 3 things!

#1 Our survey results are in!

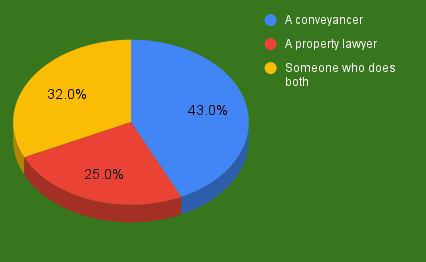

Conveyancer Vs Property Lawyer?

Our question was: As a property purchaser, would you use:

– A conveyancer

– A property lawyer

– Someone who does both

Some observations:

Personally, I like to use a conveyancer who works closely with a property lawyer or alternatively, a property lawyer. The reason being that if something goes awry, I want my conveyancer to be onto it like a dog with a bone. I don’t want to have to suggest and then engage a property lawyer at the last minute (I had a client who was once in that position and it was painful for all concerned 😥)

Property lawyers can cost a little bit more than a conveyancer (but not always a lot more) and for run-of-the-mill property transactions, you might think “Is this overkill?‘ But for me, I come from the perspective ‘I am not the expert and I don’t know what I don’t know‘ so I rely on the legal and property experts to assist me. I would call those extra few hundred dollars I might need to spend as my insurance policy!

And if there is complexity but I don’t understand the complexity, I don’t want my conveyancer to assume I have already obtained appropriate legal advice (noting that conveyancers cannot give legal advice).

#2 Updates to our Property Market Reports.

These Reports are a great resource for those looking to buy in a new region or just to get a feel for what is happening in that region. Each Report also includes a suggested recommendation to Buy / Hold / Sell.

Updated Regional Property Reports

Here are the last 3 months’ updates of these detailed regional reports (including the property clock: Buy / Hold / Sell).

There are 30+ regions analysed and they are updated regularly.

Get your Free Property & Regional Reports

#3 Phil Anderson – Guru or ….?

If you don’t know or have not heard of Phil Anderson, you are not alone. He runs a business called Property Share Market Economics and pre-COVID, he presented at a CBRE property seminar.

Phil has a contrary view on all things economic to what you might read in the media. As he says, the economy runs off the back of the price of land and the economic rent of land. And most economists don’t factor this relationship (and the cyclical nature of this relationship) into their economic forecasts.

Phil’s food for thought: Phil believes the property market runs in a predictable cycle (18.6 years is pretty precise!) and that the next peak is in 2026/27.

Further, he is predicting banks, with their higher margins from the interest rate increases will be increasing access to credit which will fuel the next series of price rises. On this I am in agreement – and, watch out for bank profits to go up even higher as a result.

Now, whether you think Phil is blowing steam from you know where or whether you agree with him, the interesting thing is that he is bullish on the property market for the next few years. And, he says he has data on his side. Of the last 10 cycles of interest rate increases, the price of property has increased 9 times (and in the 10th it went sideways).

So there you have it!

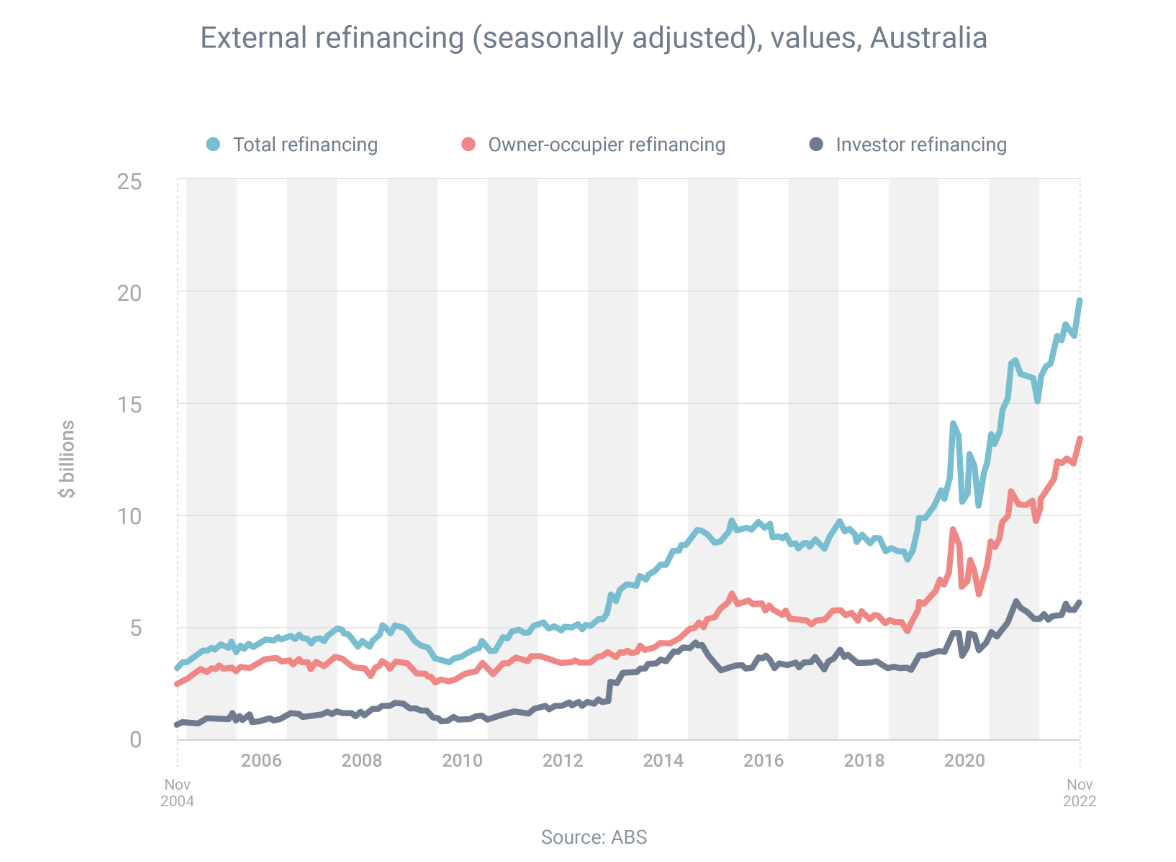

Mortgagees refinanced a record $19.5 billion of home loans in November, the Australian Bureau of Statistics (ABS) has reported.

That included $13.4 billion of owner-occupied loans (also a record) and $6.1 billion of investment loans (the second-highest on record).

The ABS had a simple explanation for the astonishing amount of refinancing that occurred in November: “More borrowers switched lenders for lower interest rates as the RBA’s cash rate target continued to rise.”

There are two reasons why so many people are able to find lower-rate home loans at other lenders.

First, rising interest rates are causing people to shop around, because not all lenders are increasing rates at the same pace.

Second, with so many lenders in the market, competition for business is fierce, so institutions often charge new customers lower rates than their existing customers.

If you like the sound of switching to a home loan with a lower interest rate, get in touch. I’ll compare the market on your behalf and give you multiple options to choose from.

Want to compare interest rates? Let’s talk!

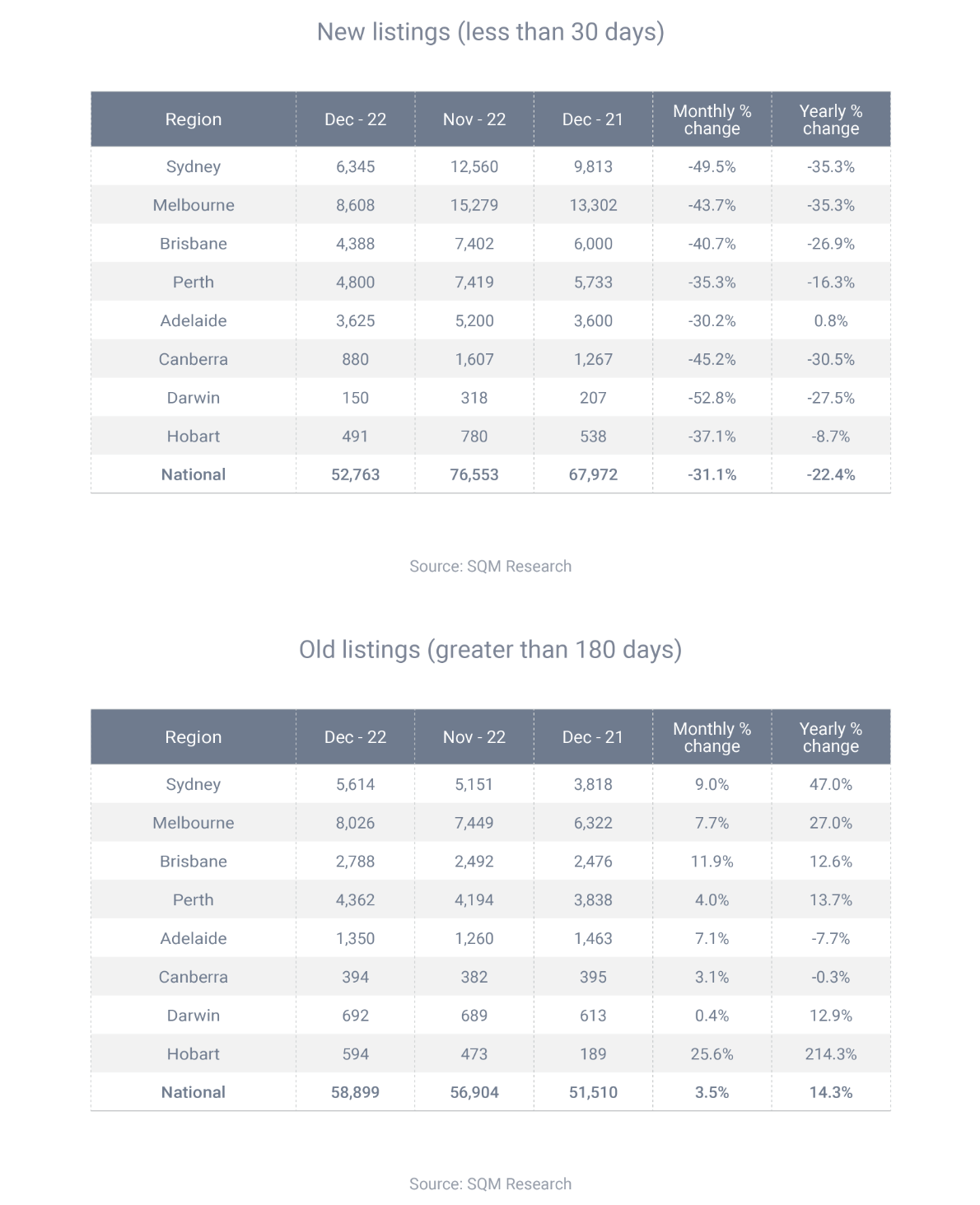

In a strange twist, the number of properties listed for sale has increased, even as the number of homes coming onto the market has decreased, according to SQM Research.

At first glance, it appears as though there must be fewer for-sale properties. That’s because, across Australia, the number of new listings (those that had been on the market for less than 30 days) in December was 22.4% less than the year before.

However, while fewer new homes are being listed for sale, those already on the market are taking longer to sell. In December, the number of listings that had been on the market for more than 180 days was 14.3% higher than the year before.

However, while fewer new homes are being listed for sale, those already on the market are taking longer to sell. In December, the number of listings that had been on the market for more than 180 days was 14.3% higher than the year before.

As a result, the total number of homes listed for sale in December was 4.6% higher than the year before.

SQM Research managing director Louis Christopher said the rise in older listings appears to be uniform across cities and towns, and is typical of what happens in a housing downturn.

“As there remains more sellers than buyers, dwellings on the market that are not priced to market, don’t sell,” he said.

Get in touch if you need a home loan!

If you fixed your home loan in early 2022 or before, and your fixed period is going to expire this year, it’s important to prepare yourself for higher interest rates.

That’s because, once your fixed period ends, you’ll revert to a variable loan, whose interest rate will almost certainly be higher.

Since May 2022, the Reserve Bank has raised the cash rate by 3 percentage points, and most banks have increased their variable rates by a similar amount.

Here are three tips to prepare yourself for a rate rise:

– Pretend your interest rate has already increased by 3 percentage points and pay the extra amount into a special savings account each month

– Look for ways to reduce your discretionary costs, such as by holidaying domestically rather than internationally or buying a used car rather than a new vehicle

– Speak to a broker ahead of time about refinancing to a lower-rate home loan once your fixed period ends

Many lenders offer special inducements to refinancers, including lower interest rates and cashback deals, which is why refinancing can be such an effective tactic.

Get in touch if you want to refinance!

The Australian Banking Association, which represents the country’s biggest banks, will make changes to the Banking Code of Practice to better protect customers.

In response to the 2021 Independent Banking Code of Practice Review, the ABA has said it would:

– Accept clear statements about customers’ rights and how to enforce them.

– Ensure banking services are inclusive of people of diverse sexual orientations and gender identities.

– Update the definition of a ‘small business’, to protect an additional 10,000 small business customers.

– Update the definition of a ‘vulnerable customer’, to better recognise that anyone can be vulnerable at any time.

The changes around vulnerable customers will also clarify the type of support available to all customers, including financial difficulty options for small businesses or those needing access to external support services such as interpreters and financial counseling.

The ABA has started work on drafting its amendments.

The ABA’s membership includes 20 of Australia’s largest banks, including the big four banks, Macquarie Bank, Bendigo & Adelaide Bank, Bank of Queensland and ING.