We’ve made it to spring – and things are starting to heat up!

Here’s what’s making news right now with property, finance and vehicles:

– First home buyer success

– Property now worth $10trn

– Govt fuel efficiency plan

– Economy remains positive

Read more below.

But first, a bit of length…..

Let’s ‘beat the chest’, talk about which lender we recommend and of course, our regional property report updates (30+ regions across Australia – ideal knowledge for investors looking outside their own backyard) and last but not least, our survey of the month (we just love a good survey!).

It’s time to…. BEAT THE CHEST!

This is not sexy but every year our aggregator, LMG (the biggest in the land), audits our files for compliance purposes (a great job if you can get it 🙂 ).

If I am going to simplify the concept of compliance down to a single phrase, I would say compliance is to ensure that brokers ‘do the right thing by their clients and keep everyone safe and on the right side of the law’.

And guess what?

We got a 10 out of 10!

Ok, I had a quick latte and got back to work. But what this shows is that we are both innovative AND we make sure we are doing the right thing by you.

As I jokingly say to clients ‘No one pays me enough to do the wrong thing’ (yes, it is a joke).

–

Which lenders do we recommend?

As a segue to the above audit result….. I will often get asked by new customers ‘Which lenders do you recommend?’ or ‘Which lenders do you use?’

Now before I answer this, let’s do a shallow dive into the broking industry (trust me, this will be quick!)

The rising role of brokers

You may have read that 70% of all home loans are now written by brokers with the remaining 30% primarily made up of customers who walk into their local bank branch; which as we know, are shrinking in number each year.

So the major Big 4 lenders are now heavily reliant on the broking industry to continue to bring them deals.

Old school brokers; those who have been in the broking business for over 10 years (it is a relatively young industry going back to the 90s), made their coin from the Big 4 and they are historically wedded to them. They grew their businesses off the back of the Big 4 and they know the Big 4 well. They understand their culture, their systems and their processes, and they have often built strong relationships with the people inside these banks.

On the contrary, those brokers who started in the industry since digitalisation became a thing (think of Covid as the catalyst) are, however, less wedded to the Big 4. They are the Tinder generation of brokers – those who find it easy to swipe left or right to find the best deal for you.

Now let’s get back to the question!

I have a cop out answer….

It depends.

BIR Finance is a young Tinder-gen broker in terms of years in the broker game (but a grey head in terms of experience in business!). So when we get asked those questions around ‘Who do you use?’ and ‘Who do you recommend?’, it is natural for us to respond ‘It depends’. It depends on you and your circumstances.

We will recommend any lender

who offers you the best deal – for you.

So we are happy to recommend the Big 4 when they offer you the best deal. However, we often find that the best deal is being offered by a non-major. I could bore you with a list of lenders’ names we use but we literally look at all 60+ lenders on our panel (and sometimes beyond our panel for those difficult to place deals) and then narrow down our search to those who will ‘LEND TO YOU’.

But what about rates, fees and charges (aka ‘price’)?

Only after we know who will lend to you do we look at the price. As with all things, price is important but if a lender won’t lend to you, their price is just a figment of some marketer’s imagination.

Now here’s the thing: as a Tinder gen broker firm, we know that there are no secrets on the loan market as most data is available somewhere on the internet.

We make it easy for you.

We say to our clients ‘Everything we see, you will see!

In fact, our first meeting with a client is nearly always by Zoom and we share all the data on which lenders are likely to lend to them and at what price (this takes about 30 minutes).

The rest of our time is spent providing the substantiation we need to satisfy the lenders and our compliance team that the deal we are recommending is in fact ‘the best deal for you’.

Find out which lenders are best for you!

–

Investors, it’s getting hotter!

Take advantage of this incredible opportunity covering over 30 regions throughout Australia. The quality of research and depth of information in these reports are unmatched. Be sure to thoroughly examine these reports before you make your next property investment choice.

Tip

Your most significant expense with your next property acquisition

is the potential cost if you select the wrong property.

If your annual return is 2% to 3% lower than it could have been, you can accumulate substantial financial losses over a span of 5 to 10 years. For instance, a 2% annual return disparity (5% versus 7%) on a $500K property acquisition translates to a capital gain gap of $63K over 5 years and $179K over 10 years.

Your solution? Use a great property investment advisor. We can put you in touch with a few we have dealt with and who put in the hard yards to give you well-researched options which are suitable for you.

Some great property investment advisors!

Below are the recent updates from the Regional Property Reports for the past three months:

Access your Regional Property Reports

–

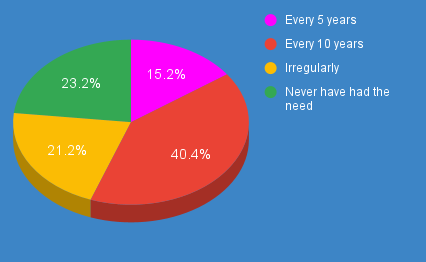

Our latest survey results are in!

Our question this month was: How often do you paint your house inside?

Some observations:

– Painters say Inside: every 5 to 10 years and Outside: every 5 years.

– When we moved into our current home, we got in the painters before we moved in, allowing us to kick off with a lovely clean interior. It was such a great decision (my wife takes the credit for that one – 100%).

– We now need a touch-up / repaint after 15 years (can you believe it??? 15 years!) the cracks are appearing. It’s time to get cracking on that repaint!

– My Dad was one of those Sydney Harbour Bridge painters. He’d start at one end then finish off (inside and out, all sanded back with undercoats – no shortcuts!) before having a few years off; and then he would start all over again. Shift work at the ABC does that to you I guess.

– And if you need a good painter (not el cheapo but they claim to use the best paints which are easy to clean and long-lasting), let me know as I can make an introduction for you.

Connect me with a great painter!

–

A recent study conducted on behalf of the National Housing Finance and Investment Corporation (NHFIC) reveals that the federal government’s Home Guarantee Scheme (HGS) has been instrumental in assisting first-time home buyers in acquiring high-quality homes with minimal initial deposits.

According to the findings, eligible first-time home buyers participating in the HGS program have the opportunity to enter the housing market with a mere 5% deposit. Over the period spanning from January 2020 to May 2023, the average deposit made by HGS participants increased by a modest 3.4%, rising from $35,200 to $36,400. In contrast, the broader first-time home buyer demographic experienced a substantial 46.7% surge in average deposits, soaring from $108,400 to $159,000 during the same period.

Furthermore, the research indicates that the average loan amount for first-time home buyers benefiting from the HGS program exhibited a moderate uptick of 4.7%. In contrast, the broader first-time home buyer market recorded a more significant increase of 13.4% in average loan amounts during the specified timeframe.

“Analysis suggests that on average, HGS participants continue to see the equity in their home grow broadly in line with long run price increases, despite the broader market declines last year. The average equity gain per HGS guarantee is estimated to be around $82,000,” according to the research.”

The HGS is a very helpful program, but not all first home buyers are eligible. I can tell you whether you qualify for the program and help you apply for a loan.

Get in touch if you need FHO guidance!

–

Australian property values have made a remarkable and swift recovery, with CoreLogic reporting that the combined value of properties in the country has once again exceeded $10 trillion.

This milestone was previously reached in early 2022 but dipped below this threshold during a nationwide housing downturn, which saw the nation’s median property price drop by 9.1%. However, over the past six months, property prices have rebounded impressively, registering a 4.9% increase.

“The recovery trend in values comes despite a cost of living crisis, low consumer sentiment levels and four increases in the cash rate so far this year amid the fastest rate hiking cycle on record,” CoreLogic said. “It begs the question, how is this possible?”

CoreLogic gave three main reasons:

1. Demand for housing is being pushed higher by a combination of returning overseas arrivals, and a drop off in overseas departures.

2. There may be some draw-down in savings, equity or profits from previous home ownership that is being used towards property purchases, as opposed to more borrowing.

3 .Total listings volumes remain fairly low, even as new listings have started to increase in the lead up to the spring selling season.

Mark my words (but this is NOT advice!):

The above micro issues are indeed true and provide support for what is happening. But they miss the bigger picture. Here is what I think makes up the bigger picture:

– With the increase in interest rates, the Big 4 are making a LOT more money.

– And, they are looking for ways to lend this money (via their Branches, via Brokers, via funding lines to second-tier lenders – and just wait for the headline of ‘Big 4 bank goes offshore to splash the cash with yet another (soon to fail) overseas investment’).

– When banks push money out their door (to borrowers), property prices go up. According to guru Philip Anderson, the correlation between interest rate increases and property price increases is 9 out of the last 10 times with the 10th time being stable prices.

–

Approximately 1200 submissions have been submitted to the federal government as part of a consultation process regarding a proposed Fuel Efficiency Standard (FES).

The response to the consultation has been overwhelmingly supportive of the FES concept. These submissions will play a pivotal role in shaping the design of the FES, which is slated to be introduced by the end of this year. It’s important to note that this standard will specifically apply to new vehicles sold within Australia.

“The FES will save Australians money, unlock greater choice of modern, safer cars, and help us achieve our critical emissions reduction target of 43% below 2005 levels,” according to the government.

“We are already seeing the price of electric vehicles drop as domestic competition and demand increases. There are currently three electric vehicle models in Australia priced under $40,000, which is below the average new car price of $50,000.”

The Federal Chamber of Automotive Industries, which represents the Australian automotive industry, said it fully supported the introduction of an ambitious, but achievable, technology-agnostic FES that was designed for the needs of Australian consumers.

–

The most important factor in qualifying for a mortgage is having a job, which is why a healthy economy is so important. Or, if you are a business owner, two plus years in business makes it easy (you can get loans with less ‘time in business’ but your choice of lender is reduced).

Recent data reveals a nuanced economic landscape: although the economy is showing signs of a slowdown, it is still in an expansionary phase, while unemployment is on the rise but remains remarkably low.

According to the Australian Bureau of Statistics, the economy posted a 2.1% growth rate for the year ending in June. Growth was consistent at 0.7% in the first two quarters, but it decelerated to 0.4% in each of the subsequent two quarters.

Concurrently, the unemployment rate has inched up from 3.5% in June to 3.7% by August. The Reserve Bank has projected a gradual increase in unemployment, reaching 4.4% by the conclusion of 2024.

There are different strokes for different folks but some lenders like longevity more than others and they price their risk accordingly. But as with most things in lending land, nothing is definitive and nothing is set in stone. That’s why God created mortgage brokers! 🙂