When it comes to managing your loan, rate checking is one of the most powerful tools you have to stay in control of your finances. Lenders are in the business of making money, and one way they do that is by quietly charging higher rates to customers who aren’t paying attention. Whether you’re a first-time borrower or you’ve had a loan for years, regularly reviewing your interest rate can make a significant difference in your monthly payments—and your overall financial health.

In this article, we’ll explore why rate checking matters, how it can save you thousands over the life of your loan, and simple steps you can take to ensure you’re always getting the best deal possible.

You only had one job! I love that line – Oceans 11, I recall. Well, once you have obtained a loan from a lender and they have given you their money, you only have 1 job (other than paying it back of course 😊).

That job is to keep checking the rate your lender is charging you – month after month. After all, you need to understand lenders are in the game of making money – and they make their money from you (and they make more if you are not watching them). So, you need to keep checking the rate your lender is charging you – unless you have a broker who is diligently doing this for you.

Strange but true…. the funny thing is, I often hear people tell me ‘I know I should check my rates as I am probably paying too much’ but then, they ark up when it comes to paying for something they or their family really needs.

If you want to be able to save more money or spend more money without changing a thing, then what I am about to share is for you.

This leads me to ask you this question: Who would you rather give your hard-earned $$$ to?

😍 You and your family?

Or,

😮 Your lender?

Tough choice, right?

In this article, I will show you that when it comes to your loan, that is your choice. And if you do nothing after reading this article, your default answer is ‘Your lender’.

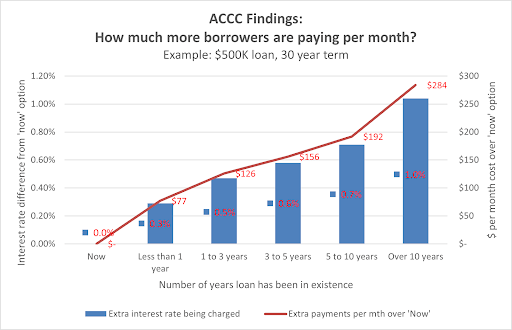

The ACCC’s 2020 report into housing loans and interest rates, showed that virtually EVERY borrower is paying more than their lender’s ‘current best rate’. Higher rates equal higher monthly payments – which also means less money in your pocket for you to spend (but more profit for your lender).

Let’s have a look at what the ACCC said in their report, converted into a $500,000 loan:

What this graph says is:

– Borrowers who had borrowed $500,000 during the last year were paying, on average, $77 MORE per month than they needed to (i.e. which equates to a higher interest rate than that which was currently available of 0.3%pa). Ouch!

– And, those who borrowed more than 10 years ago were paying, on average, $284 MORE per month (which equates to an interest rate they were paying of slightly greater than 1.0% pa. higher compared to the current best rates).

So the moral is, the longer you leave your loan with your current lender without ‘rate checking’, the more you will be paying compared to their current best rate. And, on the evidence from the ACCC, most borrowers willingly pay way too much as they don’t ‘rate check’.

Client story: And to confirm this data, one of our clients had an $850,000 30–year loan with a major, well–known lender – just shy of 10 years since it was written. She was paying her lender almost $9,000 per annum more than she needed to – that’s over $170 each week!!! Her loan product was a variable rate loan with an offset account and her lender was charging her 3.63%pa. The best rates for a loan she could qualify for were as low as 1.99%pa; and, there were 20 lenders offering rates of less than 2.5%pa. So choice was not an issue for this client!

Click here to do the maths for you and your loan: your loan repayment calculator

You might be wondering, ‘How can the banks get away with this?’ Well, as with most major retailers, their new customers get their best rate (the equivalent of the infamous ‘loss leader’ or ‘introductory’ priced specials) and you, their existing customer, who doesn’t regularly check out and negotiate, gets their higher profit margin rate – with a bit of rate slippage thrown in where they can, so that as the years go by, you, their loyal customer, ends up paying way too much.

Now, before we give you a neat solution, let’s clarify one thing: we are talking about Variable Rate loans – not Fixed Rate loans. If you have a Fixed Rate loan, you are not ‘stuck’ with your current lender, but you do have some issues other than the interest rate to consider if you are looking at refinancing. For example, Fixed Rate loans normally have a break cost if you decide to refinance before your fixed-rate term expires. And this cost can be significant.

With a Variable Rate loan, subject to a few qualifications, you can change lenders and loans whenever you want. No break fees with no (or little) in other costs. There is a whole separate topic on the costs and benefits of Variable Rate Vs Fixed Rate Loans Vs a hybrid of both which we will cover in a separate paper. But for now, we are talking about refinancing your Variable Rate loans.

Your 4 Step Process to get the interest rate you deserve

You can follow this 4 step process yourself or, if you want, we can do it all for you – at no cost to you.

Step 1: Do the research

Everything starts with research. The hard yards. The slightly boring yards. Either you or your broker has to do these hard yards (your lender won’t – they are sitting back chilling out on the rate you are being charged).

Go online to your lender’s website and see what their current advertised rate is for your product, then, compare it to the rate shown on your statement.

Go to a rate checking site and see what the best rate is you think you could get. This can be a bit tricky if you are not comparing like for like with your loan’s product features.

Hints:

1. Make sure you know which product you have with your lender before you start your research.

2. Get a copy of your current loan statements. Online is often easier these days via your lender’s online portal unless you are being mailed paper-based copies and you are keeping them handy. From your statement, grab your current rate plus your account details (you will need these for Step 2).

Step 2: Talk (to your bank)

This is when it gets interesting! A simple request to your lender, armed with your information from your research is now needed.

But…. be prepared for some frustration as you are about to experience the wonderful ways lenders make it difficult for their ‘existing’ customers to quickly reach the right person!

Your options: you can try to contact them via their Contact Us on their online portal or via their website; you can send an email (trying to find ‘the right’ email address for this can be tricky 😊); or, you can ring them – but be prepared for a half hour wait (or longer). Remember, you are not their ‘next customer’; you have already bought from them, so they are not in a rush and urgency is much less (for them).

Show them your research and see if they will match their current best rate for you or even better, match a competitor’s best rate.

Step 3: Success! Follow up required

Once you have communicated with your lender, AND they have promised to reduce your rate to their current rate, it is time to make sure they hold their promise to you – and reduce your rates when they promise to do so. Don’t forget to check your new statements to make sure the rate change has been implemented.

Step 4: Eternal Vigilance

Now is the time to watch your lender’s rates for their next rate change. When any lender makes a public announcement relating to a rate reduction, check your lender and see if they adjust their rate. We recommend doing this a month or so after a lender (not yours) announces a rate change as it can take time for an industry-wide rate change to filter through to all lenders.

So, what can this process save you over time?

Well, for each rate change of 0.1%pa on a $500,000 loan, the benefit is going to be around $372 pa for a 30-year loan. That’s a small amount but over time, you will find that the interest rate differential can become quite sizeable. For example, the ACCC research suggested a less than 1-year loan was already at a 0.4%pa difference from the current best rates.

One thing to look out for:

– Beware if you have a Fixed Rate loan AND a Variable Rate loan

Let’s say you have a $500K loan made up of a 3-year fixed rate loan for $250K and a variable rate loan for $250K and you are in year 1 when your lender changes your variable rate down by 0.1%pa. Now, whilst the above 4 Step process still holds, your negotiation strength is reduced as you are stuck with your lender for 3 years UNLESS you are prepared to break your fixed-rate loan agreement. And breaking this agreement will typically come at a cost, commonly called a break fee cost. This is the lender’s way of saying to you ‘if you want to take advantage of our fixed-rate product and you decide to cancel out of it early, we are incurring a cost in time and potentially rate cost (I won’t go into the details of why there is a rate cost for your lender if you break your fixed-rate agreement as the reasons can be complex and varied but it is their option under their agreement with you).

If you had the time, you might look at the break cost and think about whether the potential saving from breaking your agreement with your lender was a practical possibility for you – but remember, there will be a time cost to doing this too as you will need to find a new lender.

Client Story: one of our clients had decided to get a mix of fixed-rate and variable-rate loan products as they viewed interest rates were likely to rise in the next few years. They should know as they are experts in macroeconomics! Anyway, when I went in to re-negotiate their rate, they were paying on their Variable Rate loan, the lender pushed back and effectively said ‘Your client is stuck with us for the next 4 years. l can give them a small reduction in their variable rate but not the full amount.’ They knew my clients could not go elsewhere without paying the break cost to extradite themselves from their fixed rate facility. I did the maths and, without complicating the story too much, the lender was correct. The break cost of over $8,000 made the break-even point of any possible rate reduction a few years away.

12 good reasons to refinance + a bonus extra!

Other than paying too much, there are other good reasons to refinance. Here is a checklist for you to consider. Before we go into these reasons, let me share with you another client story.

Client story: One of my client’s properties had increased in value dramatically over the past few years; particularly their family home, which had increased in value from $1.3M to $1.8M in 3 years! Nice if you can get it 😉

They wanted to ‘lock in’ this upside in value by obtaining what is called an equity-release loan. This is sometimes also called a ‘cash-out’ loan as that is the end objective. They had no specific purpose in mind and in the short term, they were going to place these surplus funds in an offset account until they had something to spend it on.

We did the analysis and found that they could borrow up to $900K more than their current loan limits ($800K) i.e., a total of $1.7M. Their net debt remained at $800K and they would pay interest on only $800K if they placed their surplus funds ($900K) into what is called an offset account (which is connected to their loan account but sits as a separate account with its own statements etc.)

Our analysis considered their income and expenses as well as the values of their properties and their current loans and credit limits. Even at $1.7M, their LVR (Loan to Value Ratio) was still well below 80% so there was no requirement to pay any LMI (Lenders Mortgage Insurance).

Because of the lenders we recommended them to consider, they were able to borrow this additional money ‘no questions asked’ and at highly competitive rates. There were other lenders who would have considered lending my clients a large amount of ‘cash-out’ like this, but they needed documented evidence as to how my clients were going to spend this money (e.g. a Contract of Sale, building contracts etc). As my clients had no specific and committed purpose for their funds, these lenders were not an option.

Of note, as part of our initial enquiries, we also considered whether their existing lender would provide this cash-out facility. As they had a maximum limit on cash-out of $350,000 for existing clients, they were not an option (even though their rates were competitive). In other words, it is always good to see if you can stay with your current lender. You should only consider a change if they cannot provide what you are after or, they are going to charge you too much to stay.

# |

The good reason |

Relevant for you? |

|

1 |

You are paying too much in interest because your lender does not adjust your rates to their current ‘sharpest’ rate. See the examples above. |

Yes / No |

|

2 |

Your borrower profile has improved. So, you can obtain a lower rate loan. Perhaps when you first applied, your credit score was impacted or your income was lower but now, you are flying at a higher level. |

Yes / No |

|

3 |

Your property value has increased. Now, you have a lower Loan to Value Ratio (LVR) which will give you a better interest rate with a suitable product. |

Yes / No |

|

4 |

You have some personal goals. Take a holiday, buy a car, renovate… and you would like to use the increase in equity in your home (its value less your loan) to do just that. |

Yes / No |

|

5 |

You want to build your wealth. Using your available increase in your equity might be able to fund the purchase of another property. |

Yes / No |

|

6 |

You want a more suitable loan product.

Perhaps you thought you didn’t need an offset account but now you have surplus funds earning you zilch interest after tax and if you had an offset account, you could save the full value of your loan interest rate. Or, perhaps you want to lock in a Fixed Rate loan before you think the rates go up. Or, perhaps you are on Interest Only and want to change to Principal and Interest to start making a dent in the amount you owe. |

Yes / No |

|

7 |

Your Fixed Rate loan period is about to expire, and the Variable Rate being offered by your current lender is not that attractive (HINT: it won’t be attractive – they are banking (sic) on you not checking). |

Yes / No |

|

8 |

You want to take advantage of benefits being offered by lenders such as Cash Rebates. |

Yes / No |

|

9 |

You want financial freedom. By paying off your loan more quickly (because you can) allows you to think clearly about your future without debt. |

Yes / No |

|

10 |

You want to reduce your financial stress. You can do this by increasing your loan term and paying less each month (but more in the longer term). Still, lower stress is a good thing if things are tight financially. |

Yes / No |

|

11 |

Family issues need to be resolved. As unfortunate as it is, a family break-up will probably require a refinance for one of the parties if they wish to stay in the family home. |

Yes / No |

|

12 |

Consolidate your debts. When life has been a bit stressful and you have personal debts and loans, it can be smart to consolidate your debts into your lower-interest rate home loan. Just be careful you don’t think ‘I’ve got 30 years to pay this off’ as the longer term and ongoing interest repayments will eat into the short–term interest rate saving you thought of when you decided to consolidate your debt. |

Yes / No |

|

13 |

Pay off the taxman. You are a business owner and you have found that your business has got behind in paying the ATO. The ATO may be a bit impatient and want payment sooner than the longer–term payment plan you had in mind. |

Yes / No |

So, go to it! Look after you and your family and have a look and see what you can save!

Or, give me a call and I can do it all for you – at no cost to you.

Book a time for a chat: Calendly

Check our other blogs here!

Would you like more information? You can ring us now 1300 989 878 or email us at moreinfoplease@bir.net.au

ACCC (Australian Competition & Consumer Commission): https://www.accc.gov.au/focus-areas/inquiries-finalised/home-loan-price-inquiry