🎄✨ Season’s Greetings! ✨🎄

What’s not to like about Santa!

As we unwrap the joy of the holiday season, our newsletter is adorned with twinkling lights of inspiration and tidings of merriment.

‘Tis the season to be jolly, and our newsletter is the sleigh ride of festive delight you won’t want to miss. Let the festive fun begin! 🎅🎁🌟

Your 2024 Christmas gift – book it in early (aka now 😉).

Over the course of 2024, a lucky reader of this wonderful newsletter will have the opportunity to obtain a cashback of $1,000 in time for Christmas next year (if nothing else it will teach you patience).

What you need to do: before 15 February 2024, book a time to start your loan application. As long as your loan settles in 2024, you will go into the draw for the $1,000 cashback.

Draw: 30 November 2024 (yes, it’s a Saturday – I have diarised it).

Limit of one cashback per settled loan but, hey, a thousand bucks is not to be sneezed at!

But wait, there’s more!

This offer is extended to include all current loans in progress and any loans settled in 2023 (we need a cut-off somewhere!).

So get cracking and book a time to get your loan started!

To get started: book a time to have a chat (there are dates all the way up to 15 February so no excuses!) PS I am officially closed on the 25th and 26th December plus 1 January (recovery day) 😉

– – – – – – –

Meanwhile, here’s the latest in the news.

As we begin the countdown to Christmas, there’s a lot of interesting finance and property news out there.

Here’s what caught my eye:

– Fixed vs variable loans

– Investor borrowing rises 16%

– Top 5 car loan mistakes

– RBA reveals rate rise data

Read more below.

– – – – – – –

Attention investors, the market is heating up!

Seize the extraordinary opportunity spanning across more than 30 regions in Australia. The reports provided offer unparalleled research quality and in-depth information. It is crucial to thoroughly review these reports before making your next property investment decision.

Reminder: Opportunity Cost can be your biggest loss

The most significant cost associated with your upcoming property acquisition is the potential expense of choosing the wrong property.

To illustrate, a 2% annual return difference (5% versus 7%) on a $500K property investment results in a reduced capital gain of $63K over 5 years and $179K over 10 years.

The solution?

Engage a reputable property investment advisor. We can connect you with advisors who provide well-researched options tailored to your needs.

Find an excellent investment property advisor!

Here are the latest updates from the Regional Property Reports over the last three months:

Access your Regional Property Reports!

– – – – – – –

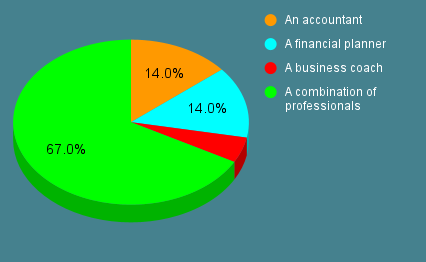

Our latest survey results are in!

To plan your future, do you use:

When we get a new client who is looking to grow their wealth, we will ask:

So who is on your team?

Our reasoning is that everyone needs a great team of advisors. You could add a legal advisor to the above mix as well.

One interesting observation is the use of business coaches. They can be pricey but that is not always the case. And for those who are really looking for targeted growth, a good coach is a valuable addition to your mix of advisors.

The interesting thing is they come in all different shapes and sizes and skill sets. What is right for one person may not be a good fit for someone else. Some focus on mindset and some on practical implementation issues and some focus more on the technical aspects of sales, operations or finance.

If you ever wondered about the value of coaches, read about the success sports stars have had with their coaches. Dustin Martin’s story comes to mind and if you haven’t read about it, see if you can find a copy (it is a bit hard to find).

Want to find a good coach? Give me a call!

– – – – – – –

Not surprisingly, as rates have increased and have started to slow down, variable-rate loans have taken over from fixed-rate loans as the preferred choice for borrowers.

Back in March 2020, when the pandemic started, only 13.4% of new home loans taken out in that month were fixed. But by July 2021, that had risen to 46.0%, as the Reserve Bank of Australia (RBA) slashed the cash rate and people took out two-year and three-year fixed-rate loans to lock in record-low interest rates. The share of borrowers fixing has since declined; since June 2022, less than 10% of all new mortgages in each month have been fixed.

Meanwhile, the share of all fixed-rate mortgages (i.e. both new and existing loans) has also been trending down. This “declined to 22% in September, well below its peak of just under 40% at the start of 2022”, according to the RBA.

“This decline largely reflects the rolling off of fixed-rate loans taken out at very low rates during the pandemic that have transitioned to variable-rate loans.”

Despite the clear shift towards variable loans, it’s still possible that fixing might be best for you personally. I can explain the pros and cons of each option.

– – – – – – –

I have been on my hobby horse for some months now – suggesting that it was more likely than not that property prices would rise with the increase in interest rates. It might sound weird logic to those who have not read my earlier prognoses but the logic is sound and historically prescient.

Property investor activity has sharply increased, which could lead to an increase in rental stock and an easing of the tight rental conditions that exist in much of the country.

In the past seven months for which we have data, the number of investor home loan commitments rose from $7.714 billion in February to $8.952 billion in September, according to the Australian Bureau of Statistics. That was an increase of 16.0%. By comparison, owner-occupied borrowing rose only 6.1%.

This influx of investors could have two impacts.

First, it could mean more buyer competition, putting upward pressure on prices for both investors and owner-occupiers.

Second, it could lead to an increase in the number of rental properties. Right now, the rental vacancy rate is an ultra-low 1.0%, according to SQM Research, due to a relative shortage of rental listings. As a result, rents are rising rapidly. An increase in rental stock could push the vacancy rate higher, putting downward pressure on rents.

See how much you can borrow now!

– – – – – – –

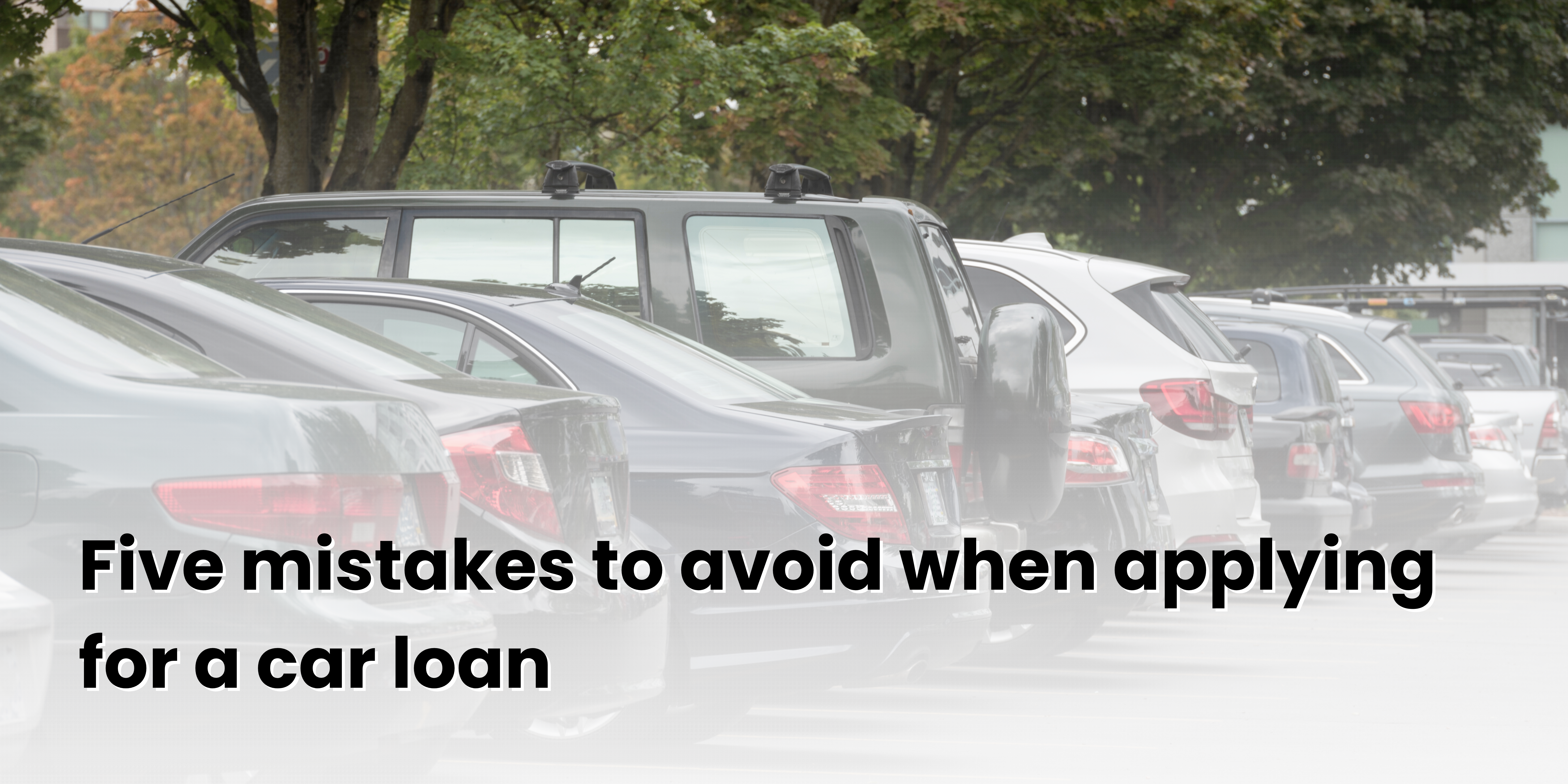

Buying a car with the help of a car loan can be a fantastic experience if you do it properly, but can have negative consequences if you get it wrong. That’s why you should take care to avoid these five mistakes.

Don’t spend money unconsciously. Six months before you apply for a loan, review your expenses. Chances are, you’ll find some unnecessary spending you can cut without any change to your lifestyle and other spending you can cut with minimal impact. The more you reduce your spending, the more borrowing power you’ll have when you apply for a loan.

Don’t leave the loan until the end. It’s best to get a car loan pre-approval before you start looking for a vehicle. That way, you’ll know your borrowing power – and, therefore, how much you can spend. Plus, and most importantly, it puts you in control as you know you ‘have the cash’. The car salesman is no longer in the driver’s seat!

Don’t get a loan without shopping around. There are dozens of car loan lenders in Australia, so interest rates, fees and borrowing criteria can differ significantly from institution to institution.

Don’t obsess about the interest rate. Yes, the interest rates are very important. But so are the loan’s fees and features as well as the choice of lender. Sometimes, a higher-rate loan may be a better option for your personal circumstances than a lower-rate loan, particularly if you are looking at things like an early repayment.

Don’t get pressured into dealer finance. When you buy a car, dealers will often talk up the benefits of letting them arrange your loan as well. But dealers generally work with just one lender, which means you’ll be given the best loan for them but not necessarily for you. Again, that’s why it’s vital you shop around.

As your broker, I can help you avoid all five of these mistakes and get a great car loan.

Get in touch if you need a car loan!

– – – – – – –

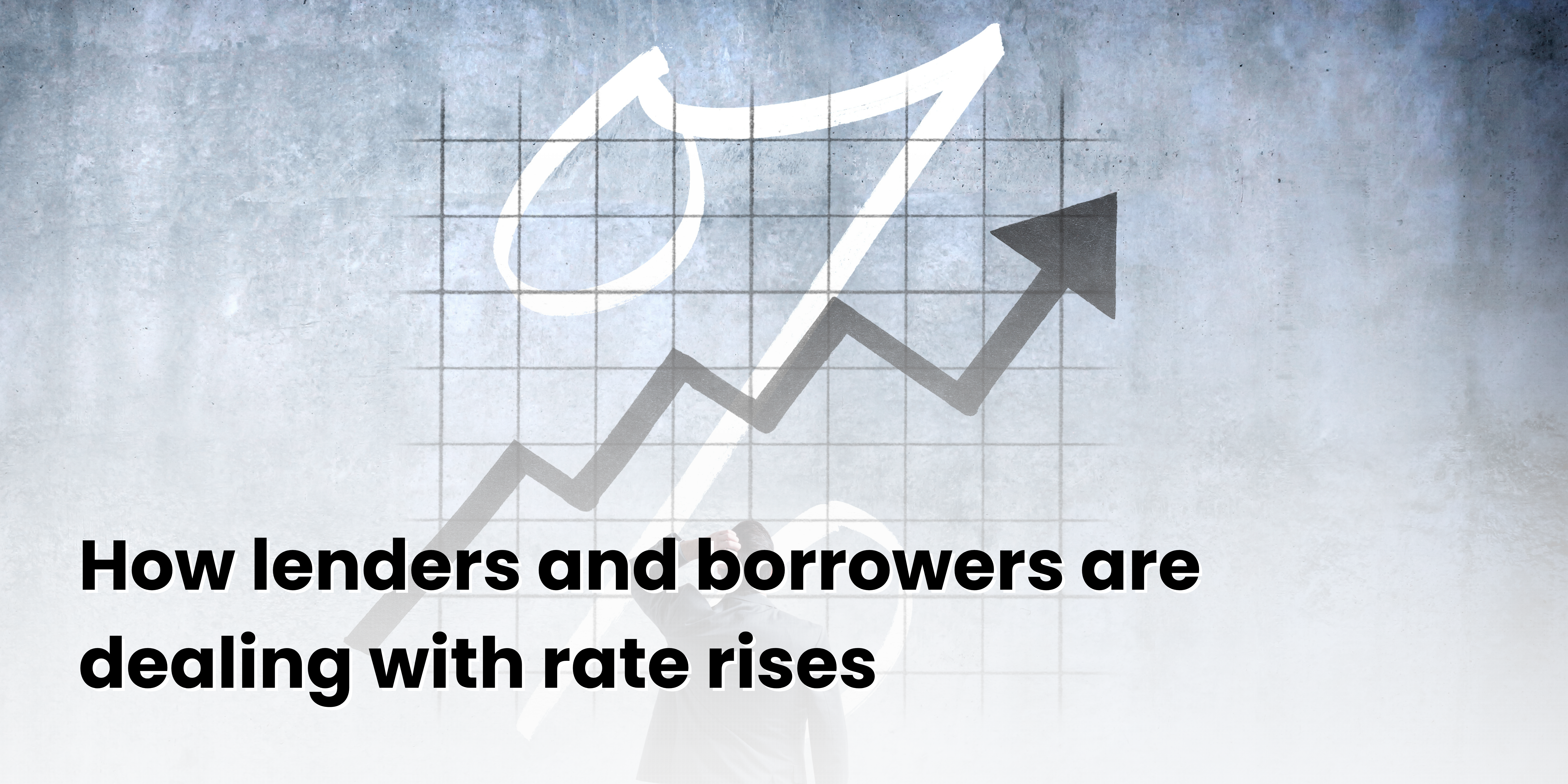

Reserve Bank of Australia (RBA) data has revealed the average lender has not passed on all the cash rate increases that have occurred in 2022 and 2023.

Between May 2022 and September 2023, the RBA increased the cash rate by 4.00 percentage points. But, on average, variable interest rates increased by only 3.32 percentage points for owner-occupiers and 3.28 percentage points for investors.

The RBA said this reflected “the willingness of banks to negotiate discounts to retain existing customers” and showed “the effect of competition between lenders on variable-rate housing loans”.

Before this cycle of interest rate increases, many households were clever in getting ahead of their mortgage repayments while rates were very low, by paying extra money into offset and redraw accounts.

“While borrowers in aggregate are still adding to this stock of savings, some borrowers have been drawing down funds in these accounts. This is consistent with pressures on disposable incomes due to interest rate rises and increases in the cost of living,” according to the RBA.

– – – – – – –

Check our FREE Property Report!