Author: Michael Royal, Finance Specialist, BIR Solutions www.bir.net.au

March 2022

How do you turn a large fortune into a small fortune? Get a reno! 🤣🤣🤣

So, you have run out of space or you just need to spruce things up. You have a chat with your architect and you see the estimated cost and your heart sinks….

It seems like even the smallest renovation will cost you more these days. Prices for building supplies have gone up and timeframes have blown out as stock sits ‘on the wharf’ – or worse, at the supplier’s wharf!

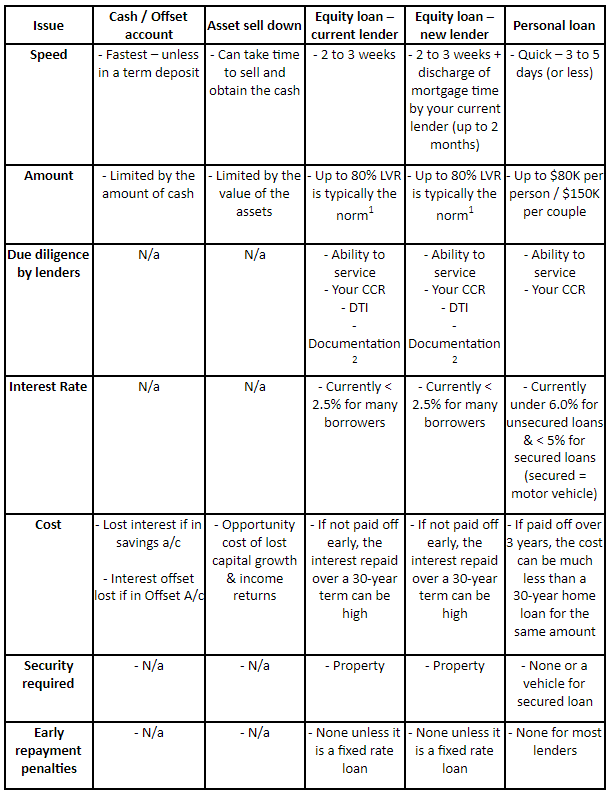

At least one thing is solved – funding your renovation. These days, you have a LOT of options so let’s run through some of the main ones you should consider:

1. Use your ‘cash at the bank’ which is sitting in either your savings, term deposit or offset account.

2. Sell down your existing assets and use the cash generated.

3. Increase your home and/or investment loan with your current lender with an equity (‘cash out’) loan.

4. Refinance your home loan and increase it with an equity loan with a new lender.

5. Obtain a personal loan.

BONUS ways:

– Your parents 😊

– Your business (if you have one and it has spare cash). PS Talk to your tax accountant to avoid/minimise Div. 7A loan issues.

Now for the details….

But first, some abbreviations used below:

> LVR: Loan to Value Ratio – the value of your loan to the value of your property (as estimated by your lender. For most borrowers, the ‘magic’ LVR maximum is 80%. Below 80% and there are no additional costs. If your LVR is above 80% you either need to be in a special class or borrower (eg medico/medical, accountant/lawyer) or you may be charged LMI by your lender.

> LMI: Lenders Mortgage Insurance – an insurance policy you pay to an insurance underwriter to protect the lender in the event of you defaulting. It is often applied when the LVR is greater than 80%.

> Equity loan (or cash out a loan): when you receive cash as well as the loan to be financed to either purchase the property or refinance the current loan.

> CCR: Comprehensive Credit Report. A report was prepared by a credit agency (Equifax, Illion, and Experion).

> DTI: Debt to Income Ratio. The ratio of your total interest-bearing debts to your ‘assessable income’.

> Security: the asset used by the borrower to secure the loan from the lender. For renovations it is property. Only personal loans may look at vehicles as security.

Notes:

– You can obtain Cash out with an LVR over 80% with certain lenders and under specific circumstances. Typically, LMI will be charged and other restrictions might apply.

– Depending upon the lender, the documentation required can vary from the usual documents required to get a loan plus a statement of intent or with some lenders, signed contracts.

Other observations:

– For people who generate surplus cash, offset accounts are a good way to save on interest.

– Selling investment assets (property, shares, artworks, etc.,) is a little bit like ‘robbing Peter to pay Paul’. Check with your financial advisor before proceeding.

– The amount you borrow in excess of your current home loan balance would be seen as an equity or cash-out loan by your lender (or a new lender). Some lenders require a lot more detail on the purpose of the cash out than others. Some lenders require, for example, signed contracts for the expenditure whilst others only need a declaration of intent.

– Lenders have 4 main criteria when assessing a loan – and some lenders look at some more than others:

> Your ‘after-loan’ LVR.

> Your ability to service the new loan balance.

> Your resulting DTI. DTIs above 6 times start to reduce the number of available lenders but some major lenders will go as high as 9 times and there are some lenders who don’t use DTI.

> Your creditworthiness. Your CCR Score.:

1. A credit score of more than 700 is good and less than 500 is bad – and in between requires an explanation.

2. Defaults or judgments are not liked by many lenders.

3. Late payments of your current loans are not liked by many lenders.

– Personal loans typically don’t require security over your properties and for renovations, most would be unsecured.

– Personal loans have limited terms (typically 3 to 5 years) whilst an increase in a home loan that is refinanced is typically ‘reset’ for a 30-year term.

To summarise:

– To be able to fund your next renovation, there are lots of ways to obtain a renovation loan.

– You need to take into account the various issues impacting your situation and work through which option is most suitable for you.

– Like all loans, the longer you take to repay them, the more you will end up paying in interest.

Would you like more information? You can ring us now 1300 989 878 or email us at moreinfoplease@bir.net.au